THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

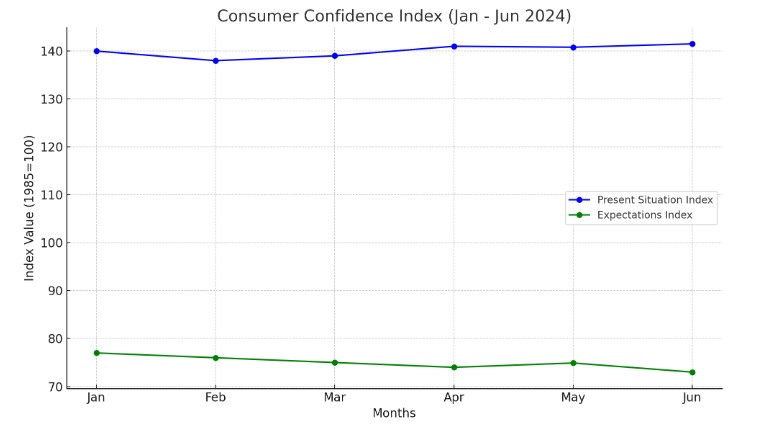

The latest data from The Conference Board reveals a slight dip in the Consumer Confidence Index® for June, with the index decreasing to 100.4 from May's 101.3. Despite this decline, the Present Situation Index, which evaluates current business and labor market conditions, improved slightly to 141.5 from 140.8 in May.

The Expectations Index, reflecting consumers' short-term outlook on income, business, and labor market conditions, fell to 73.0 in June, down from 74.9 in May. Notably, the Expectations Index has stayed below the recession-indicating threshold of 80 for five consecutive months.

"Consumer confidence pulled back in June but remained within a consistent range observed over the past two years. Strong views on the current labor market continue to balance concerns about the future. However, potential weaknesses in the labor market could lead to a further decline in confidence as the year progresses," stated Dana M. Peterson, Chief Economist at The Conference Board.

Consumers' perceptions this month were mixed. While views on the present situation improved, especially concerning the labor market, current business conditions showed a slight decline. For the second month in a row, consumers were marginally less pessimistic about future labor market conditions, yet their outlook on future income and business conditions weakened, impacting the overall Expectations Index.

The decline in confidence from May to June was primarily seen among consumers aged 35-54. In contrast, those under 35 and those aged 55 and older reported an increase in confidence. Income groups did not show a clear pattern. On a six-month moving average basis, the highest confidence levels were among the youngest (under 35) and wealthiest (earning over $100K) consumers.

Peterson added, "Compared to May, consumers are now less concerned about a forthcoming recession. However, their assessment of their Family's Financial Situation, both currently and for the next six months, was less positive." It is important to note that these measures are not included in the calculation of the Consumer Confidence Index®.

Inflation expectations for the next 12 months slightly decreased from 5.4% to 5.3%. Consumers continue to feel the impact of elevated prices, particularly for food and groceries, followed by concerns about the labor market and political situation in the US. Interestingly, fewer respondents believe the 2024 election will significantly impact the economy compared to the sentiment in June 2016, though slightly higher than in 2020.

Regarding the stock market, 48.4% of consumers expect stock prices to rise over the next year, compared to 23.5% who anticipate a decline and 28.1% who foresee no change. Additionally, the percentage of consumers expecting higher interest rates over the next year dropped to 52.6%, its lowest level since February.

On a six-month moving average basis, plans for purchasing homes remained historically low in June, with little change observed. Car buying plans also showed stagnation. However, buying plans for most major appliances and smartphones increased slightly, while fewer consumers planned to purchase laptops or PCs.

The number of consumers planning vacations in the next six months continues to rise, surpassing last June's levels. More consumers are opting for domestic travel over international trips, and traveling by car remains more popular than flying. Despite this increase, vacation plans are still about 10 percentage points lower than pre-pandemic levels.

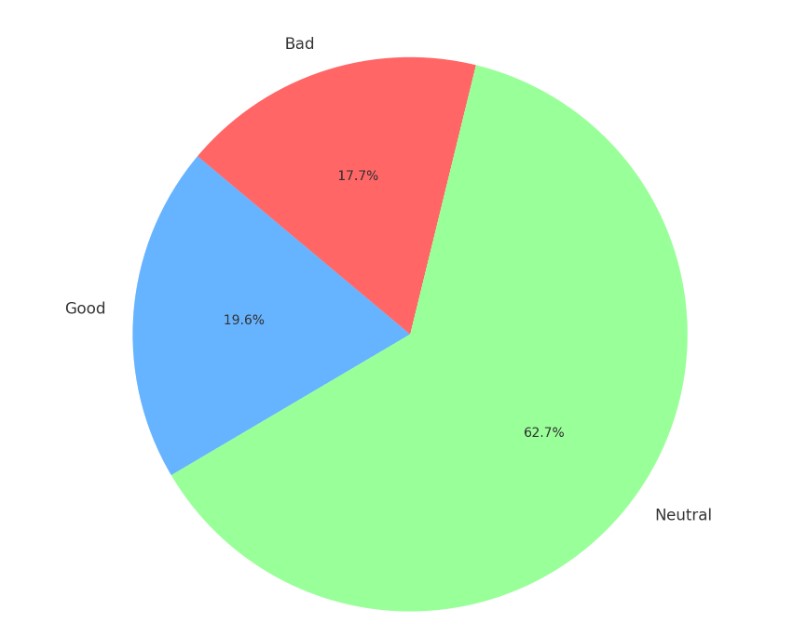

Business Conditions: Slightly less positive in June, with 19.6% of consumers rating conditions as "good," down from 20.8% in May, and 17.7% saying conditions were "bad," down from 18.4%.

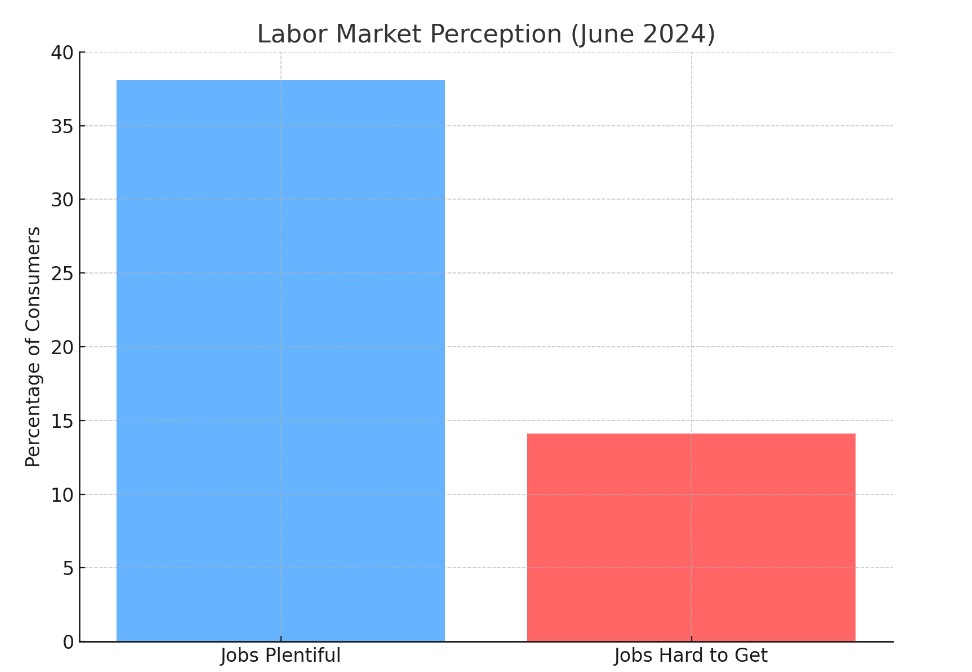

Labor Market: Improved with 38.1% of consumers stating jobs are "plentiful," up from 37.0%, and 14.1% indicating jobs are "hard to get," down from 14.3%.

Expectations for the Next Six Months

Business Conditions: 12.5% expect improvement (down from 13.7%), and 16.7% foresee worsening conditions (down from 16.9%).

Labor Market: 12.6% expect more jobs (down from 13.1%), while 17.3% anticipate fewer jobs (down from 18.8%).

Income Prospects: 15.2% expect an increase (down from 17.7%), while 11.7% expect a decrease (up from 11.5%).

Current Financial Situation: Weakened in June.

Future Financial Situation: Virtually unchanged.

Perceived Recession Risk: Decreased after rising in May and April.

The Conference Board's monthly Consumer Confidence Survey®, conducted online by Toluna, is based on a panel of over 36 million consumers. Preliminary results were collected up to June 19.

For further details and subscription information, visit The Conference Board's website.

The Conference Board is a non-partisan, non-profit think tank providing trusted insights on future trends. Established in 1916, it holds a 501(c)(3) tax-exempt status in the US.

For more information, visit ConferenceBoard.org.

Source: June 2024 Consumer Confidence Survey® by The Conference Board.

Comments