THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

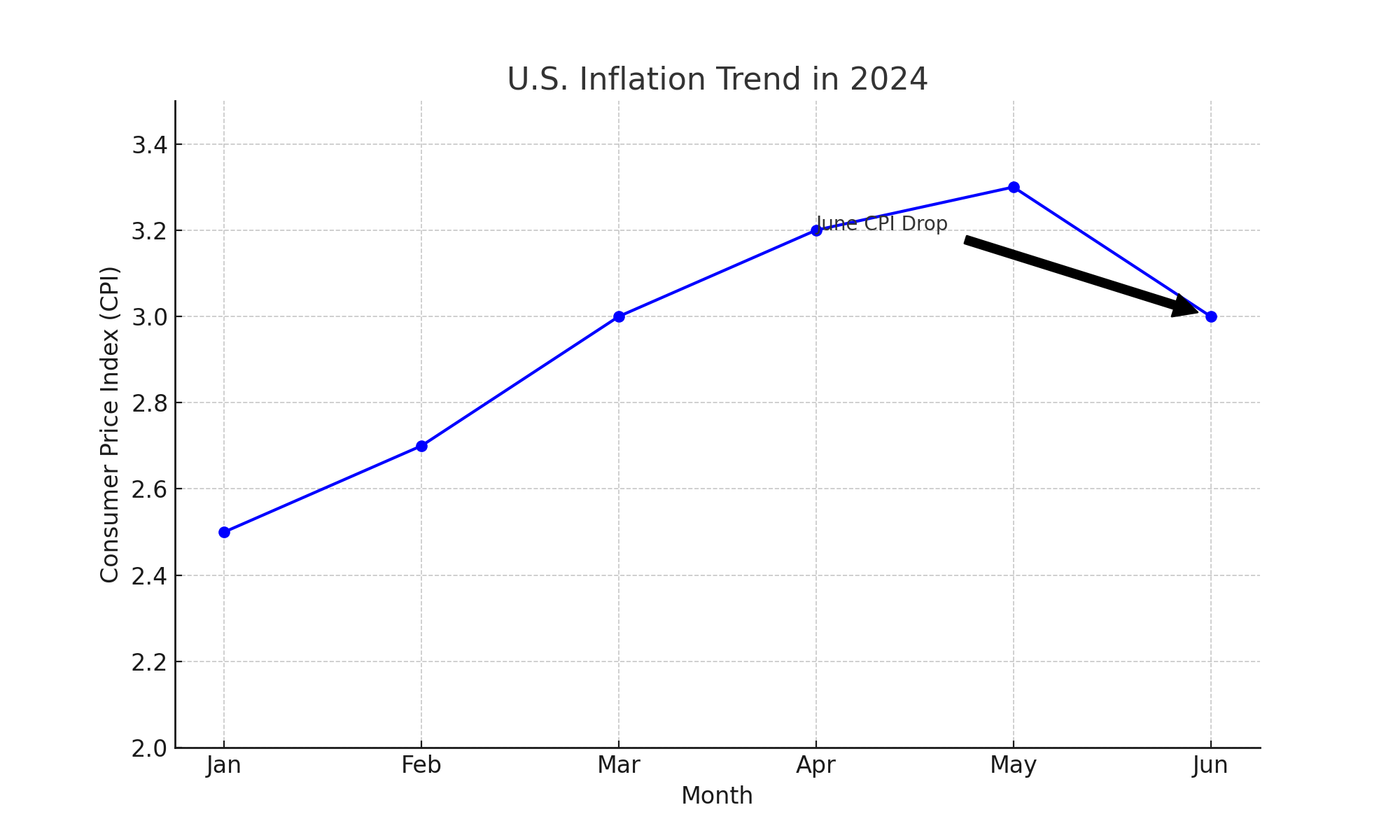

In a notable shift, U.S. inflation slowed down in June, according to the latest data from the Bureau of Labor Statistics. The Consumer Price Index (CPI) revealed a 0.1% decrease from the previous month and a 3% increase compared to the same month last year. This represents a decline from May's flat month-over-month change and 3.3% annual rise. Both of these figures surpassed economists' expectations, which had predicted a 0.1% monthly increase and a 3.1% annual gain.

This is the first time since May 2020 that the monthly CPI has turned negative, and it's the slowest annual price increase since March 2021.

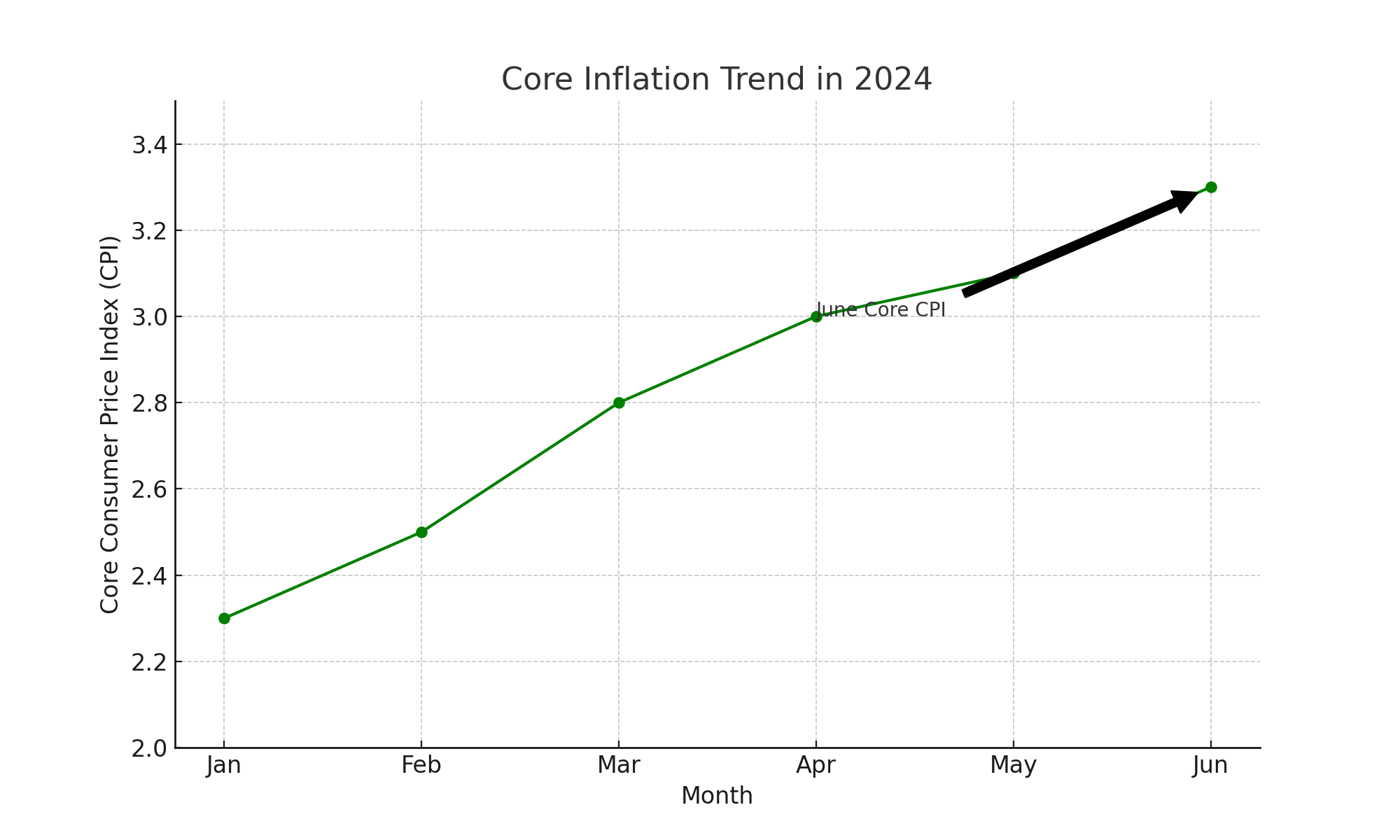

When excluding the volatile costs of food and gas, "core" prices in June rose by 0.1% from the previous month and 3.3% from last year. This is a slower increase than May's data, where economists had expected a 0.2% monthly rise and a 3.4% annual increase. June’s core price rise is the smallest month-over-month increase since August 2021.

Following the release of this report, markets reacted positively. The 10-year Treasury yield dropped by about 10 basis points to around 4.2%.

Despite inflation remaining above the Federal Reserve's 2% target, recent economic data suggests that the central bank might reduce interest rates sooner rather than later. After Thursday's inflation data, market expectations for a rate cut in September rose to 89%, up from 75% the previous day, according to CME Group data.

This data supports the case for potential Fed rate cuts. On Friday, the Bureau of Labor Statistics reported that the labor market added 206,000 nonfarm payroll jobs last month, surpassing the expected 190,000. However, the unemployment rate unexpectedly increased to 4.1%, the highest in almost three years, from the previous month's 4%.

Moreover, the Fed's preferred inflation gauge, the core PCE price index, showed that inflation eased in May, with a 2.6% year-over-year increase, the slowest in over three years.

Ryan Sweet, chief U.S. Economist at Oxford Economics, noted that the decrease in CPI strengthens the argument for the Federal Reserve to cut interest rates in September, especially with a softening labor market. However, he warned against assuming this decline represents a new trend.

Seema Shah, chief global strategist at Principal Asset Management, agreed that the recent data supports a potential rate cut in September but ruled out a July cut. She mentioned that a July cut could raise concerns about the Fed's inside knowledge and that more evidence of decreasing price pressures is needed.

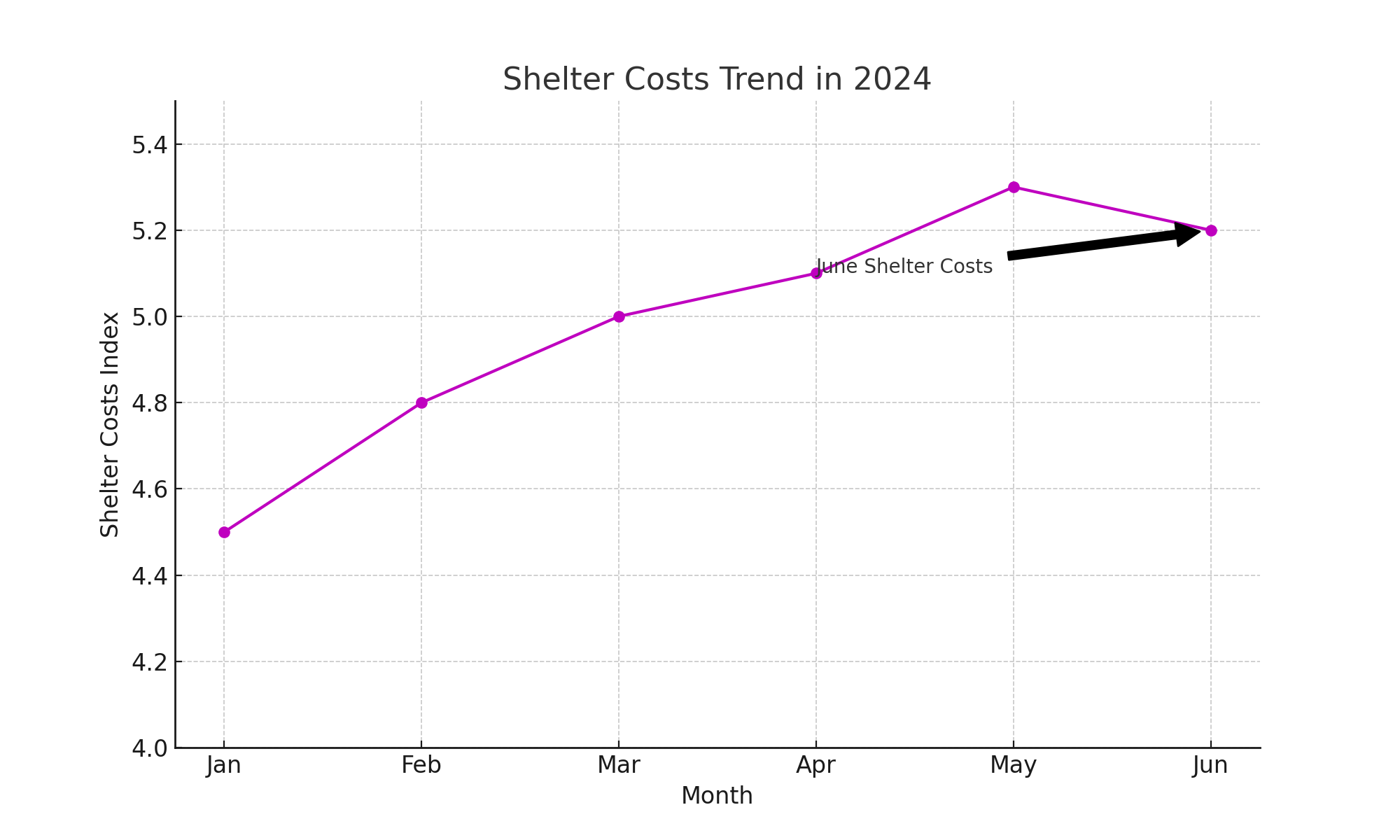

Key highlights from the report include a slowdown in shelter costs, which rose by 5.2% annually, down from May. The monthly increase was 0.2%. The persistent shelter inflation has been a significant factor in higher core inflation readings, but June's data indicates some cooling.

The rent and owners' equivalent rent indexes, hypothetical rents homeowners would pay, both increased by 0.3% month-over-month, the smallest rise since August 2021. Additionally, lodging away from home fell by 2% in June.

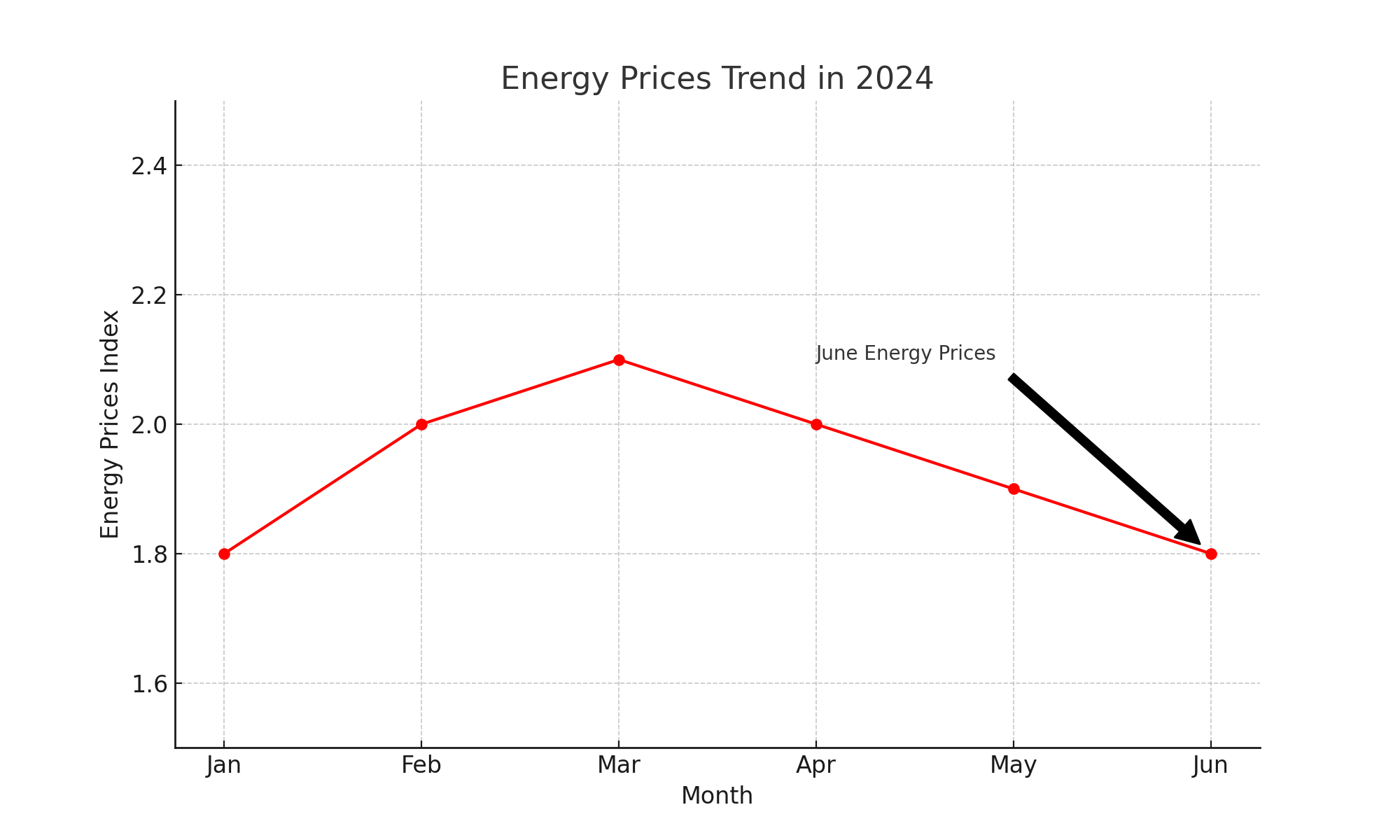

Energy prices also decreased, with a notable drop in gas prices, which fell by 2% from the previous month. On a yearly basis, energy prices rose by 1%. Gas prices alone dropped by 3.8% from May to June, following a 3.6% decrease the prior month.

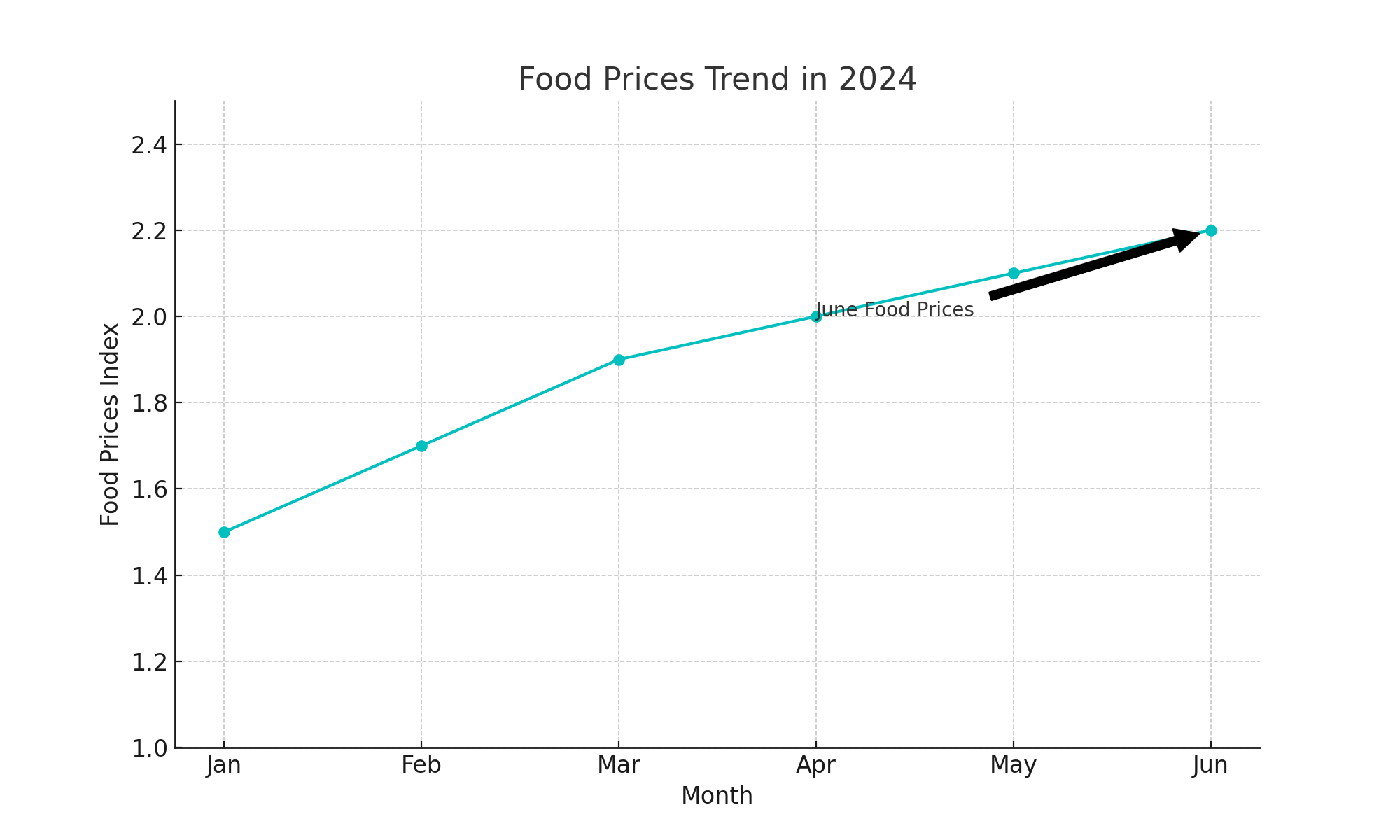

The food index increased by 2.2% annually, with a 0.2% rise from May to June. Food prices at home went up by 0.1%, while food away from home saw a 0.4% increase.

Other indexes that rose in June included motor vehicle insurance, household furnishings and operations, medical care, and personal care. In contrast, indexes for airline fares, used cars and trucks, and communication saw decreases, according to the BLS.

Stay updated with the latest developments on U.S. inflation by following our website. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments