THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

Chairman Brown, Ranking Member Scott, and esteemed Committee members, thank you for the opportunity to present the Federal Reserve's semiannual Monetary Policy Report.

The Federal Reserve remains steadfast in our dual mandate to promote maximum employment and stable prices for the benefit of the American people. Over the past two years, the economy has made significant progress towards our 2 percent inflation goal, with labor market conditions cooling while remaining robust. These developments suggest that the risks to achieving our employment and inflation goals are becoming more balanced.

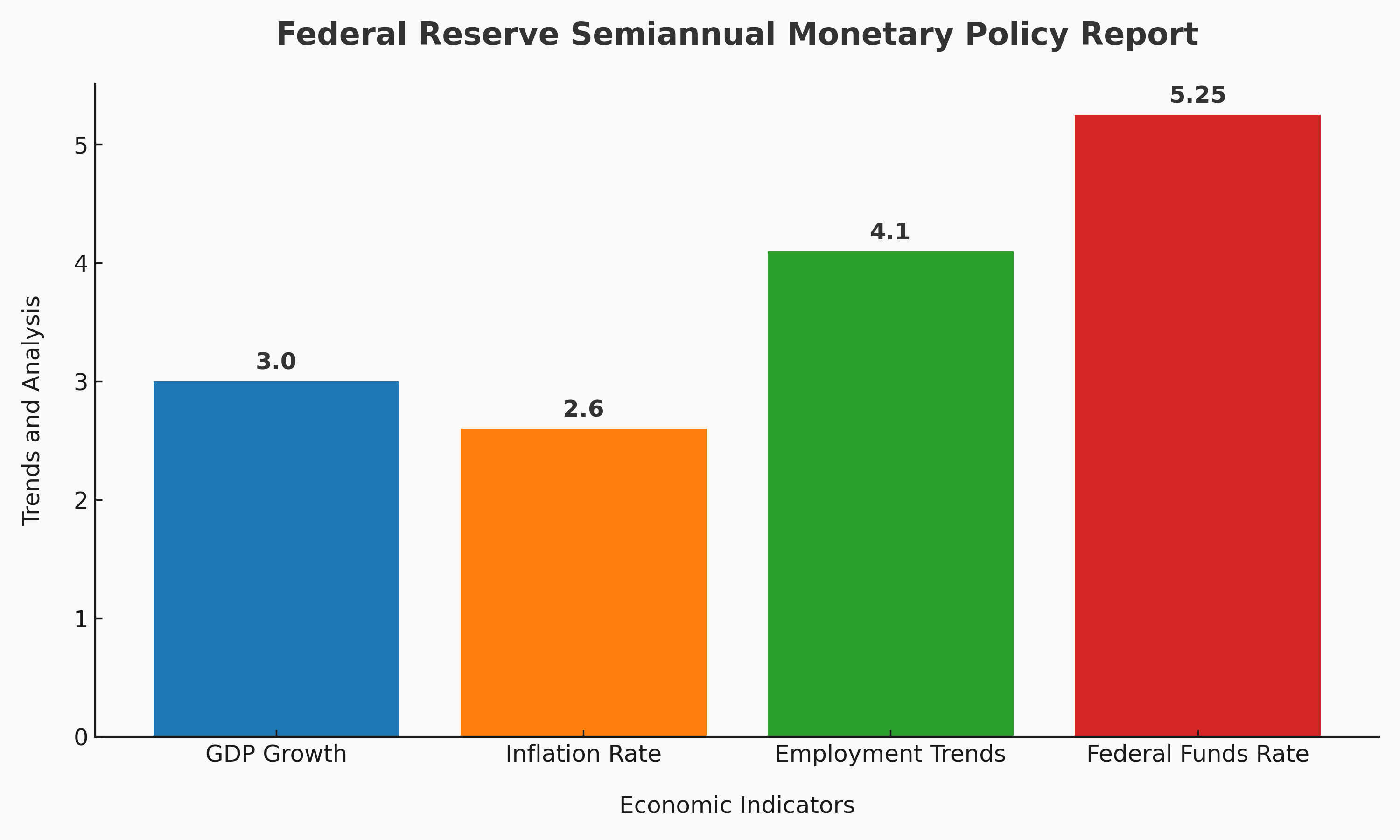

Recent indicators show that the U.S. economy continues to expand at a solid pace. While gross domestic product (GDP) growth moderated in the first half of this year following strong growth in the latter half of last year, private domestic demand remains robust. Consumer spending continues to grow at a steady pace, and we've seen moderate growth in capital spending alongside a rise in residential investment. Improving supply conditions have supported resilient demand, contributing to the strong performance of the U.S. economy over the past year.

In the labor market, a broad range of indicators suggests conditions have returned to levels seen before the pandemic: strong but not overheated. The unemployment rate rose to 4.1 percent in June, remaining low. Payroll job gains averaged 222,000 per month in the first half of the year. The increase in labor force participation among individuals aged 25 to 54 and a strong pace of immigration have boosted the supply of workers, narrowing the jobs-to-workers gap to just above its 2019 level. Nominal wage growth has eased over the past year, and the robust labor market has helped reduce longstanding employment and earnings disparities across demographic groups.

Inflation has eased notably over the past two years but remains above the Committee's longer-run goal of 2 percent. Total personal consumption expenditures (PCE) prices rose 2.6 percent over the 12 months ending in May, with core PCE prices (excluding food and energy) also increasing by 2.6 percent. After slow progress towards our 2 percent inflation objective earlier this year, recent monthly readings show modest further progress. Longer-term inflation expectations remain well-anchored, as reflected in various surveys and financial market measures.

Our monetary policy actions are guided by our dual mandate. To support these goals, the Committee has maintained the target range for the federal funds rate at 5.25 to 5.5 percent since last July, following significant policy tightening over the previous year and a half. We have also continued to reduce our securities holdings, deciding in May to slow the pace of balance sheet runoff starting in June. Our restrictive monetary policy stance helps bring demand and supply conditions into better balance, exerting downward pressure on inflation.

The Committee has indicated that reducing the target range for the federal funds rate will not be appropriate until we are confident that inflation is moving sustainably toward 2 percent. Incoming data from the first quarter did not support such confidence, but recent inflation readings have shown modest progress. Continued positive data will bolster our confidence that inflation is on a sustainable path to 2 percent.

We make decisions on a meeting-by-meeting basis. Reducing policy restraint too soon or too much could stall or reverse progress on inflation. Conversely, delaying or insufficiently reducing policy restraint could unduly weaken economic activity and employment. When considering adjustments to the target range for the federal funds rate, the Committee will continue to assess incoming data and their implications for the evolving outlook, balance of risks, and appropriate monetary policy path.

Congress has entrusted the Federal Reserve with operational independence to take a long-term perspective in pursuing our dual mandate. We remain committed to bringing inflation back to our 2 percent goal and keeping long-term inflation expectations well anchored. Restoring price stability is essential for achieving maximum employment and stable prices in the long run. Our success in these goals benefits all Americans.

In conclusion, we understand that our actions impact communities, families, and businesses nationwide. Everything we do is in service to our public mission.

Stay updated with the latest developments on U.S. inflation by following our website. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments