THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss the Bid and Ask Price.

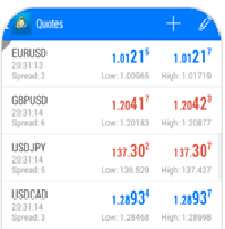

When you trade in Forex, there are two prices are seen against the single pair. One is the bid price and another is the asking price. Don’t be confused, let me elaborate on the easy way.

|

The bid price in a currency pair represents the highest price that a buyer is willing to pay for the base currency It is the price at which market participants are eager to buy the base currency. Traders who want to sell the base currency will receive the bid price if their sell order is executed. The asking price, also known as the offer price, is the lowest price at which a seller is willing to sell the base currency in exchange for the quoted currency. It is the price at which market participants are eager to sell the base currency. Traders who want to buy the base currency will need to pay the asking price if their buy order is executed. |

|

For example, let’s consider the currency pair GBP/USD. If the current quote for GBP/USD is 1.2041/1.2042, it means that the bid price is 1.2041, and the ask price is 1.2042. If you want to buy GBP (base currency) and sell USD (quote currency), you will need to pay the asking price of 1.2042. On the other hand, if you want to sell euros and buy US dollars, you will receive a bid price of 1.2041.

I hope this article is helpful for you to understand the Bid and Ask Price.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments