THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will understand Different lot sizes and calculation of values against lot size.

In the Forex market, pips and lot sizes are important concepts used to calculate profits, losses, and position sizes. Let me explain each term and how they are calculated:

Lot Size: A lot refers to the standardized trading size in Forex. Different lot sizes are used to determine the position size and the value of a pip movement. There are three main types of lot sizes:

|

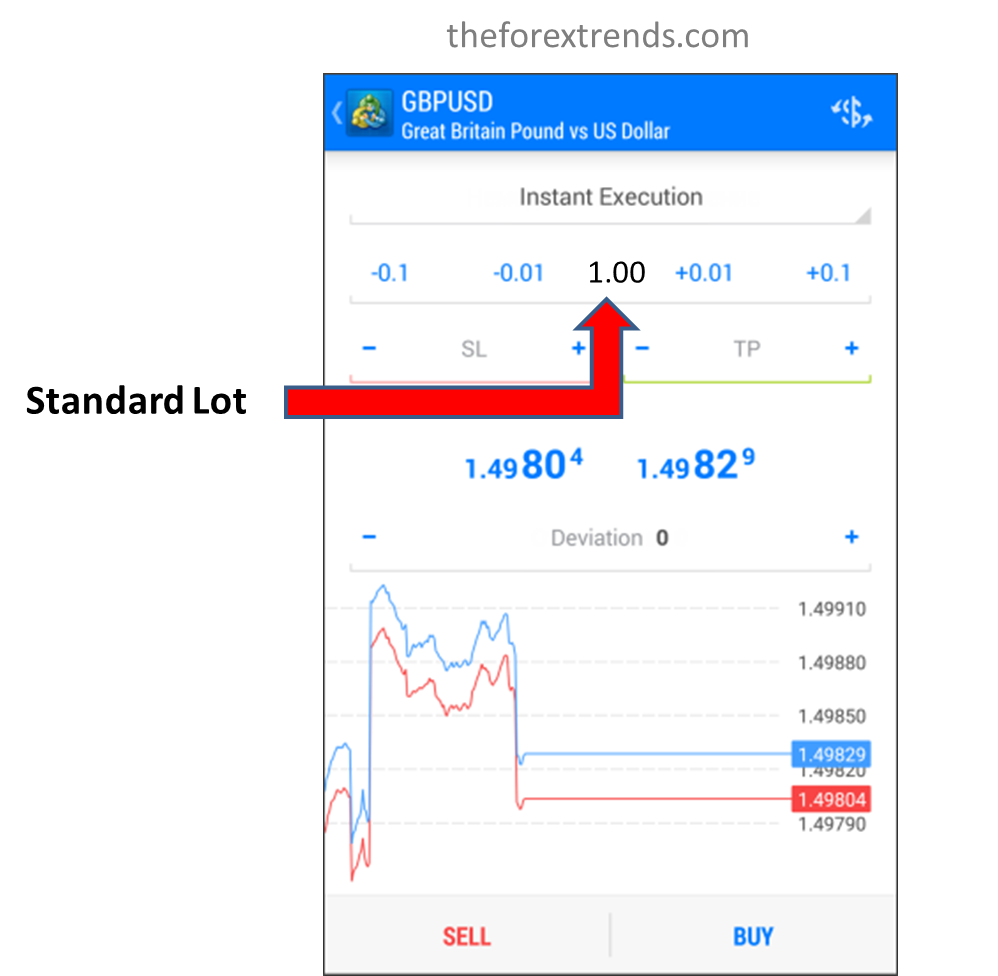

A standard lot consists of 100,000 units of the base currency. For example, if you’re trading the EUR/USD pair, a standard lot represents 100,000 euros. Whenever you execute any order by standard Lot you should put 1.00 on the lot section. |

|

|

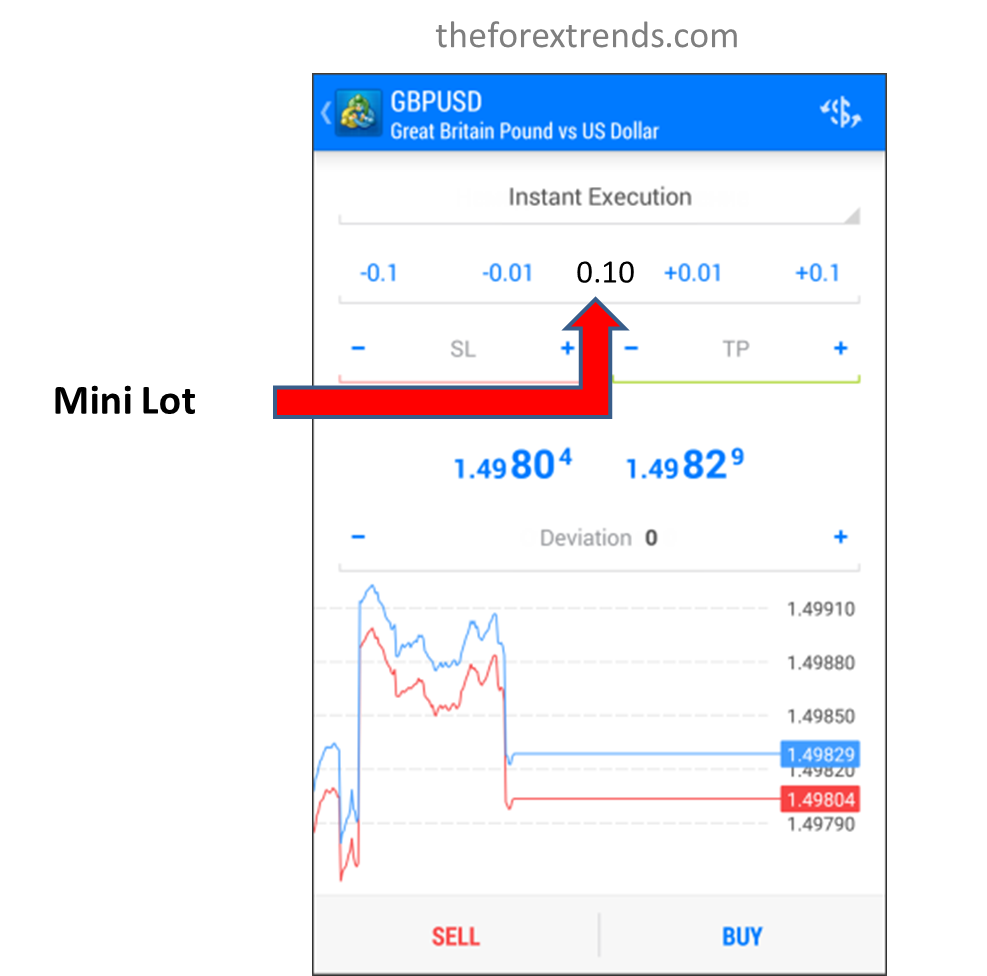

A mini lot is 1/10th the size of a standard lot, equivalent to 10,000 units of the base currency. Whenever you execute any order by Mini Lot you should put 0.10 on the lot section. |

|

|

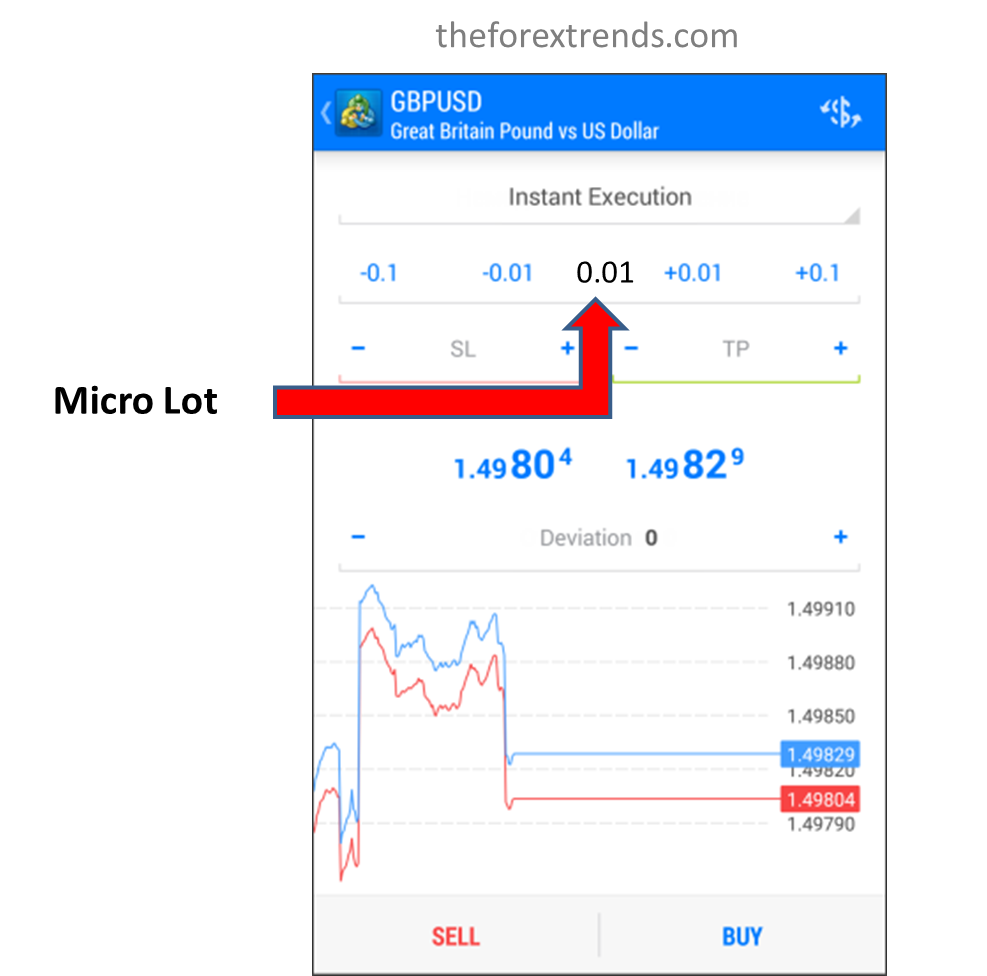

A micro lot is 1/100th the size of a standard lot, equivalent to 1,000 units of the base currency. It is the smallest lot size in the Forex market, whenever you execute any order by Micro Lot you should put 0.01 on the Lot section |

|

All above are the standardization of Lot size in theory. Nevertheless, select the Lot size as you wish. For instance, Lot size maybe 0.01, 0.02 …. 0.9 or 0.1, 0.2 …..0.9 or 1.0, 2.0 …… 100.00 onwards. It means it depends on traders, whatever they want to do.

Calculation Examples:

To calculate the value of a pip movement, you need to consider the lot size and the currency pair involved. The formula for calculating a pip value is:

Pip Value = (Pip in decimal places / Exchange Rate) * Lot Size. For example, if you’re trading one standard lot of EUR/USD, and the exchange rate is 1.2000, and the pip value is in the fourth decimal place (0.0001), the pip value would be: Pip Value = (0.0001 / 1.2000) * 100,000 = $8.33

Calculating Profit/Loss: To calculate your profit or loss, you need to know the number of pips gained or lost and the lot size. The formula for calculating profit/loss is:

Profit/Loss = (Pips * Pip Value) / Lot Size For example, if you gained 50 pips on a trade with a mini lot (0.1) on EUR/USD, and the pip value is $1, the profit would be:

Profit = (50 * $1) / 10,000 = $5

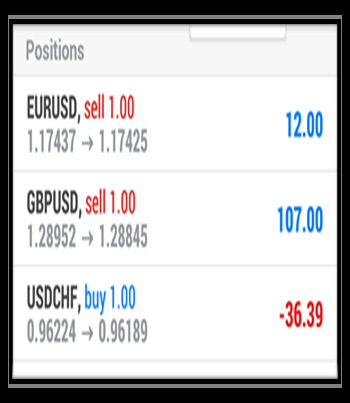

Let us make it more understandable using the tabulated format:

| Currency Pair | Market Value | Lot size | After Movement value | Total Pips Gain / Loss | Total $ Gain/Loss |

| GBPUSD | 1.2714 | 1.00 | 1.2764 | 50 | 500$ |

| 1.2714 | 0.10 | 1.2764 | 50 | 50$ | |

| 1.2714 | 0.01 | 1.2764 | 50 | 5$ | |

| XAUUSD | 1921.26 | 1.00 | 1931.26 | 100 | 1000$ |

| 1921.26 | 0.10 | 1931.26 | 100 | 100$ | |

| 1921.26 | 0.01 | 1931.26 | 100 | 10$ |

|

It is advisable that, after reading this article you have to try once on a demo environment. We will explain later how to create a demo environment to practice everything which you learned from here. These calculations may vary depending on your broker and the currency pair being traded. |

|

I hope this article is helpful for you to understand Different lot sizes and calculation of values against lot size.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments