THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

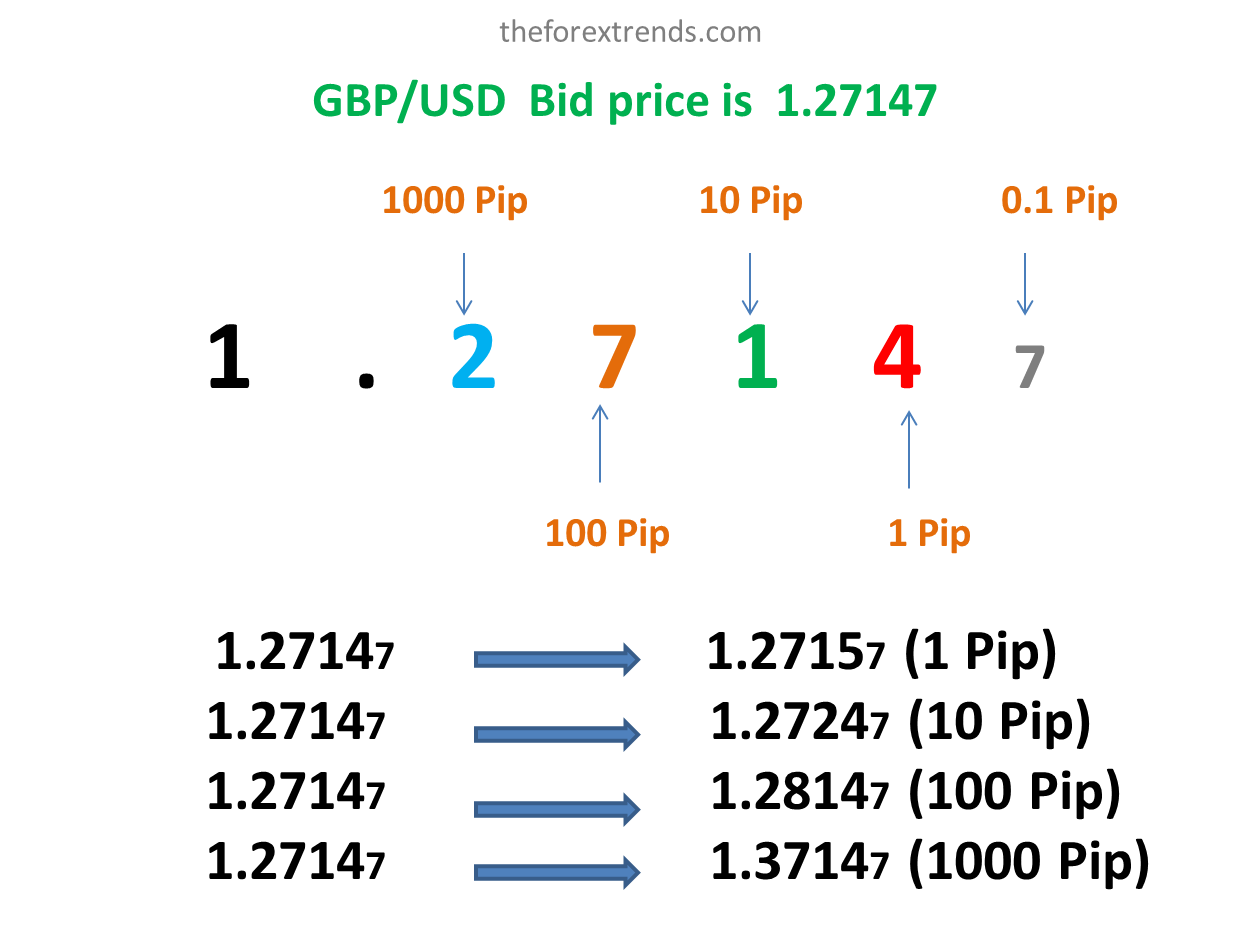

In Forex trading pips are the smallest unit of measurement and are used to measure the change in price between two currencies. The “pip” stands for “price interest point.” It is a standardized unit of measurement that represents the smallest price movement in the exchange rate of a currency pair. Pips are used to calculate profits or losses in Forex trading.

In most currency pairs, a pip is represented by the fourth decimal place, except for the Japanese yen (JPY) pairs, where it is represented by the second decimal place. For instance, if the GBP/USD currency pair moves from 1.2301 to 1.2306, it has moved 5 pips. And in the context of the JPY pair if the USD/JPY moves from 143.70 to 143.75 it has moved 5 pips. The fifth decimal place is known as pipet and it is generally not considered for calculation.

To calculate the monetary value of a pip, you need to consider the lot size of the trade. Lot sizes can vary according to you. You will learn about Lot size right next.

I hope this article is helpful for you to understand about Pips and the calculation of pips

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

It’s important to note that different Forex brokers may have variations in how they calculate pip values, so it’s always advisable to check with your specific broker or trading platform to ensure accuracy in your calculations.

Comments