THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, let’s start with the Leverage and Margin.

In Forex trading, leverage and margin are important concepts that relate to the amount of capital required and the potential for amplifying gains or losses. It’s important to know that different brokers may have varying leverage and margin requirements. Here’s a description of each:

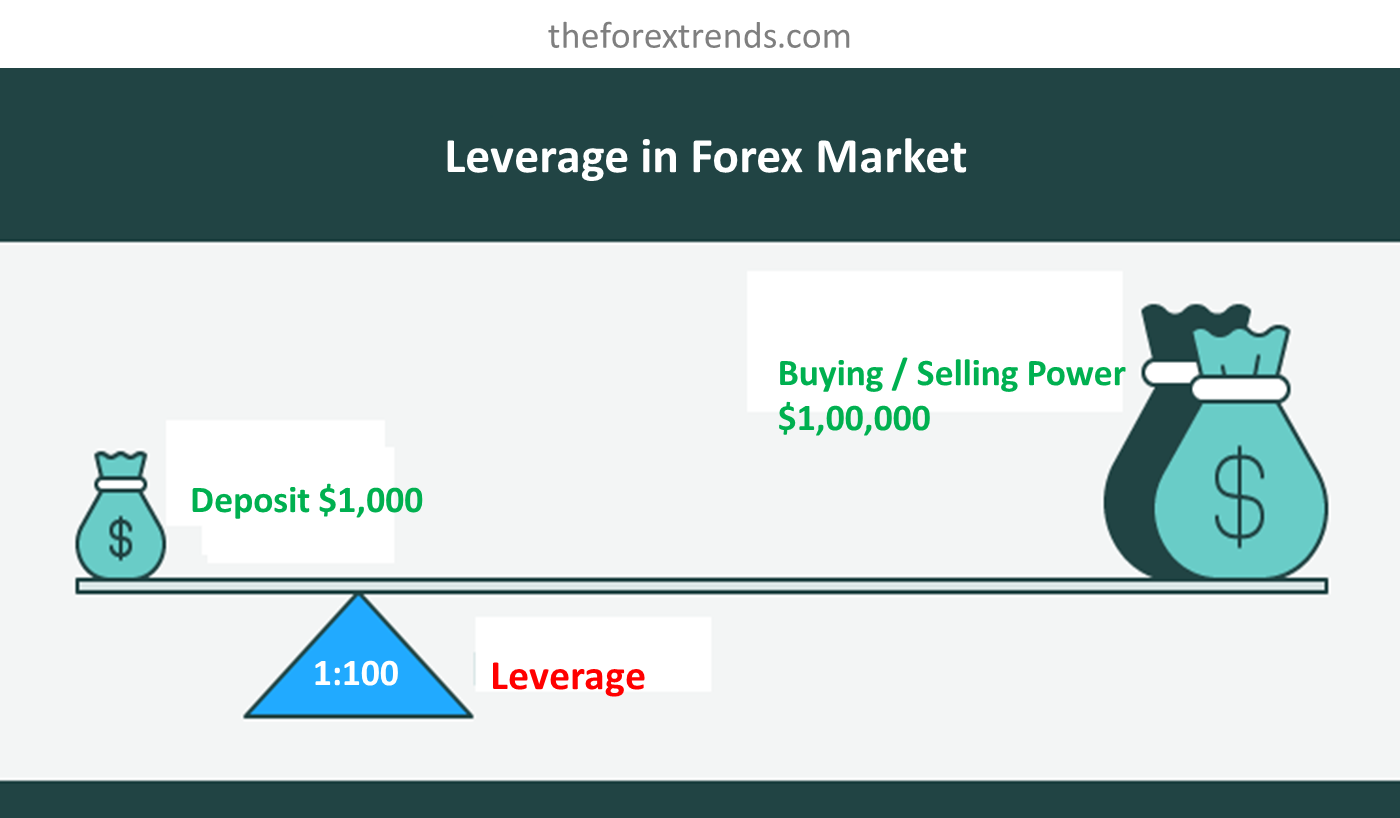

Leverage is a financial tool that allows traders to control larger positions in the market using a smaller amount of their capital. It is expressed as a ratio and represents the multiple by which a trader can increase position size. For example, a leverage of 1:100 means that for every dollar of the trader’s capital, they can control $100 in the market. That means you can maintain a position worth $100,000 with a capital amount requirement of $1000.

Leverage works by borrowing funds from the broker to increase trading power. It enables traders to potentially make larger profits with a smaller investment. However, it also amplifies the risks because losses are also magnified. Therefore, while leverage can enhance profitability, it can also lead to substantial losses if not used responsibly.

Margin is the amount of money required by a broker from a trader to maintain an open position in the market. It is a portion of the total position size that the trader must provide upfront, while the broker provides the remaining amount through leverage.

For instance, if a broker requires a margin of 1% for a trade worth $100,000, the trader needs to have $1,000 (1% of $100,000) as deposit capital. The remaining $99,000 is borrowed from the broker as leverage.

Margin serves as a safety net for the broker, ensuring that traders have enough funds to cover potential losses.

So conclusion is, that leverage allows traders to control larger positions using borrowed funds, while margin is the portion of the position size that the trader must provide as collateral. These concepts are integral to Forex trading and understanding their implications is crucial for managing risk and capital efficiently.

I hope this article is helpful for you to understand the Leverage and Margin.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments