THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will understand What is spreads.

Understanding spreads is essential for traders as it directly impacts their profitability. Lower spreads can enhance trading performance.

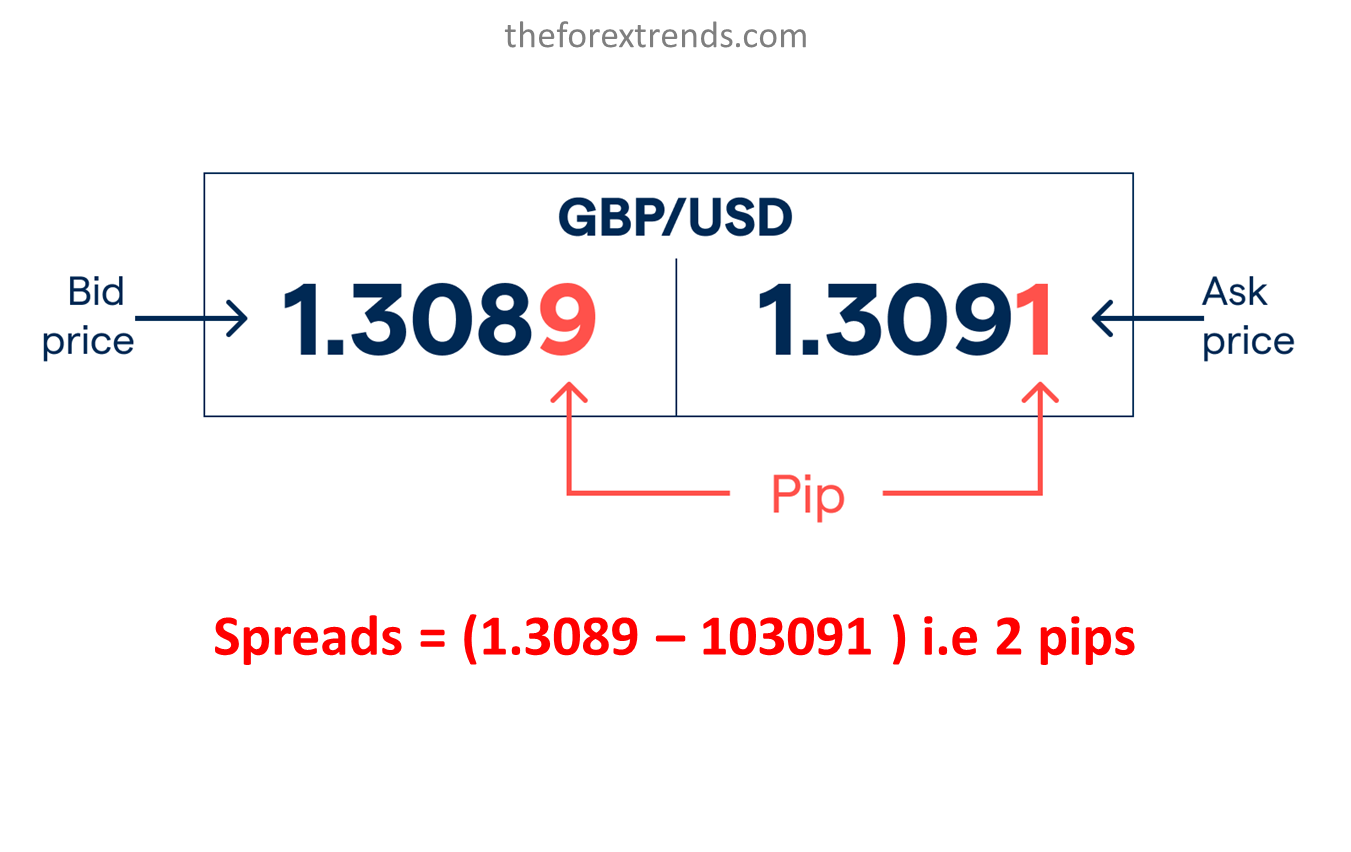

Spreads in currency pairs refer to the difference between the bid price and the ask price of a currency pair in the Forex market. The spread is typically quoted in pips (You will learn about pips right next). It is essentially the cost that traders incur when executing a trade. The spread exists because Forex brokers need to make a profit, and it serves as their compensation for facilitating trades.

As your know Currency pairs are quoted in two prices: the bid price and the ask price. The bid price is lower than the ask price, and the difference between them is the spread. For instance, if the bid price for the GBP/USD currency pair is 1.3089 and the asking price is 1.3091, the spread would be 2 pips.

Spreads can be categorized into two types: fixed spreads and variable spreads. Fixed spreads remain constant regardless of market conditions. On the other hand, variable spreads fluctuate depending on market volatility and liquidity. Variable spreads tend to widen during periods of high market volatility or low liquidity.

Spreads can be categorized into two types: fixed spreads and variable spreads. Fixed spreads remain constant regardless of market conditions. On the other hand, variable spreads fluctuate depending on market volatility and liquidity. Variable spreads tend to widen during periods of high market volatility or low liquidity.

I hope this article is helpful for you to understand What is Spreads.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments