THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

This article will explain the Basic Concept of Economic Expansion and Recession.

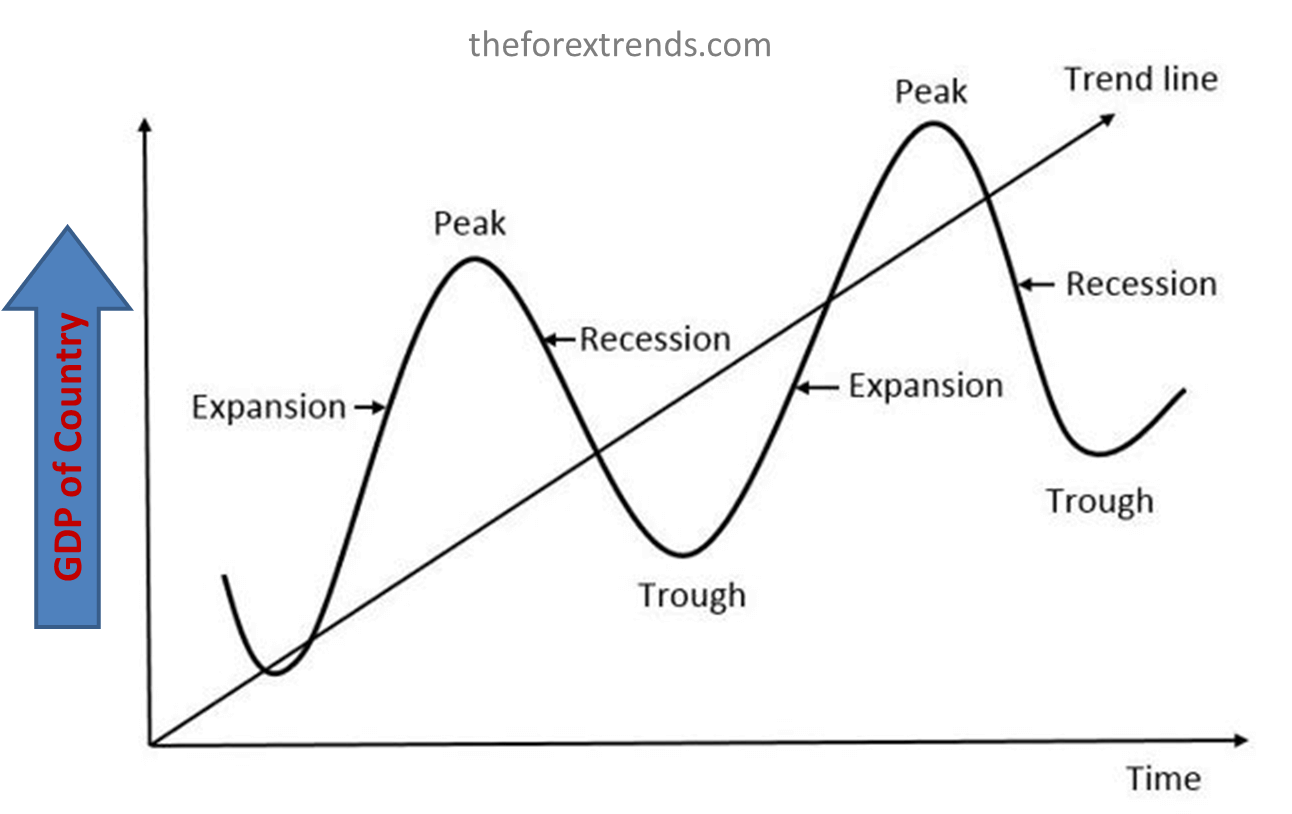

As the momentum of business activity fluctuates, the business cycle in the world economy also changes. As a Forex trader, your job is to understand the Basic Concept of Economic Expansion and recession and recognize each economy worldwide, and where their cycle is going.

An economic cycle is divided into two cycles. These cycles create a “risk-on” and “risk-off” market environment based on which investors allocate their money.

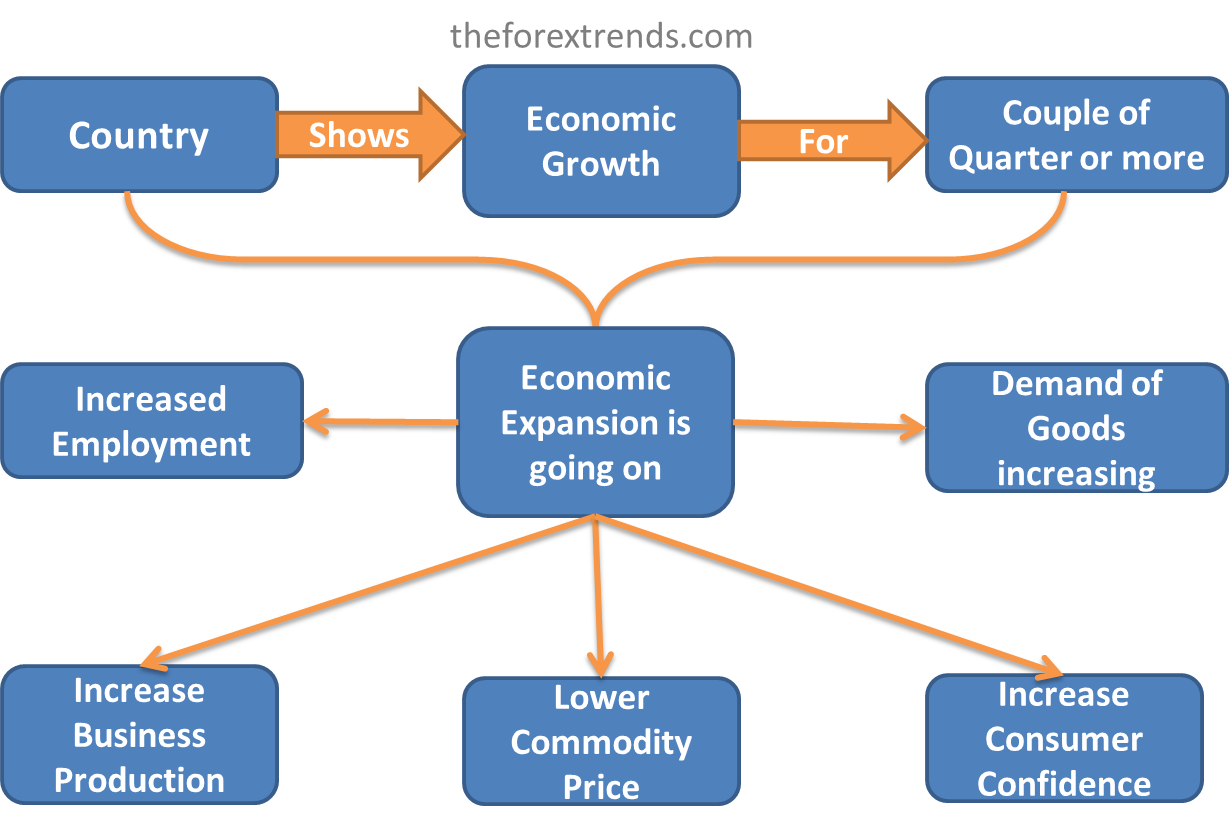

Expansions refer to a strong and growing economy. It is a phase of the business cycle characterized by increasing economic activity and growth in a country's overall output of goods and services. It is often associated with positive trends in indicators such as gross domestic product (GDP), employment rates, consumer spending, business investment, and rising stock markets. When a country’s gross domestic product goes up over a specific period of time, it is viewed as, having an economic expansion. Economic growth takes place either as a natural process or through Govt. interference.

To create demand or to add money to a financial system, the central bank of the country purchases Bonds in the open market. By that, it swaps bonds for cash that investors put into commercial banks. For that, commercial banks are more able to lend out this excess of money at low-interest rates. Due to the low-interest rates of loans, it is more affordable for small companies and big corporations, an opportunity to increase their business activities. For example, purchase manufacturing plants and high-tech equipment, and hire more manpower, so they can produce more goods and services.

To create supply, the central bank of countries can change its Reserve requirements or lower interest rates, by which taking money out of the financial system. Interest rate manipulation is a key tool central banks use for managing the economic cycle.

The below features of an expansion cycle you must remember.

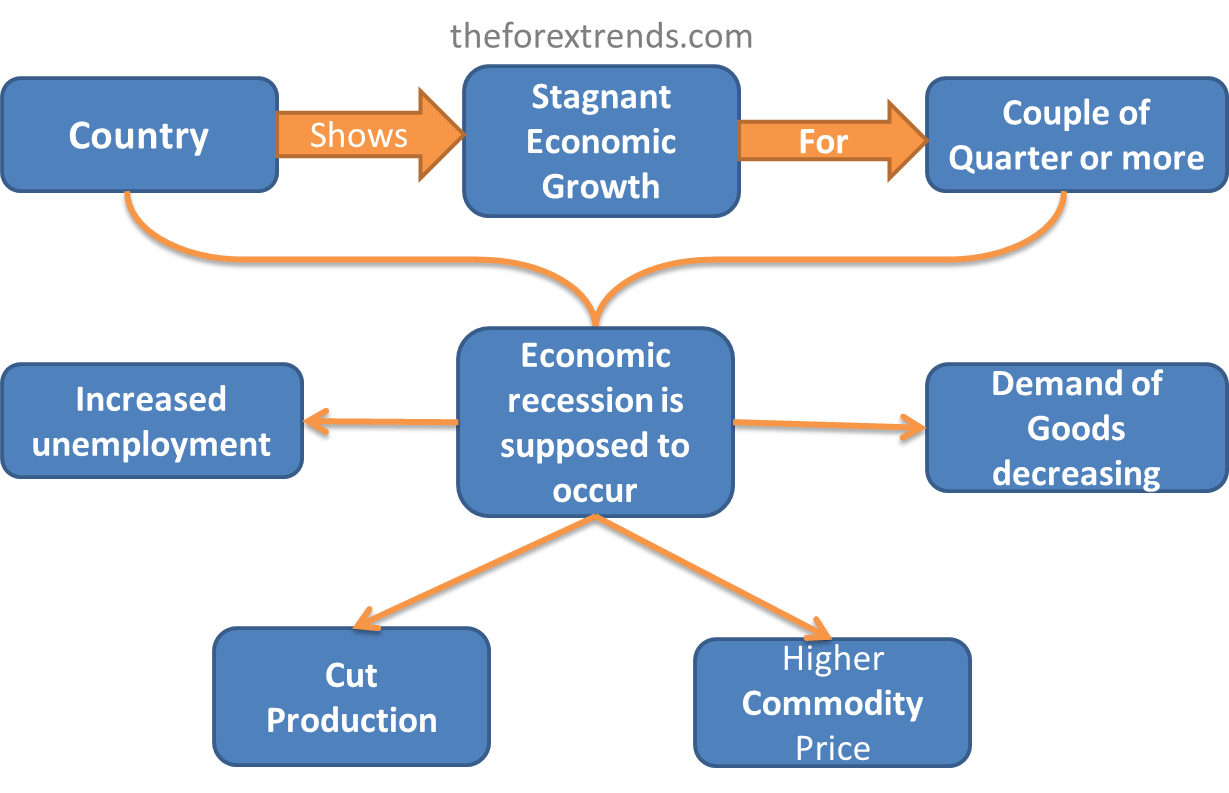

An economic recession is a period of significant economic decline, typically characterized by a contraction in GDP for a couple of quarters, widespread job losses, reduced consumer spending, and declining business activity. The recession affects the following areas of the economy:

The stock market, the Labor market, the housing market, and many more.

In this type of environment, cash supply starts to diminish as consumers limit their spending and businesses restrict their funding. It is natural that lower funding by businesses results in higher unemployment.

Generally, the recession is not good; however, it is not as extreme as the depression. Depression is considered if a recession lasts for a long time.

The below features of a recession cycle you must remember.

To address a recession, governments and central banks often employ expansionary fiscal and monetary policies. These measures can include reducing interest rates, implementing stimulus packages, increasing government spending, and providing support to affected industries. The aim is to boost economic activity, restore confidence, and stimulate spending to bring the economy out of the recessionary phase.

I hope this article is helpful for you to understand the Basic Concept of Economic Expansion and Recession.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments