THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss the Economic Indicator: Trade Balance of a Country.

The trade balance, often referred to as the balance of payments, represents the discrepancy between a nation's exports and imports during a specific period. This economic metric plays a crucial role in influencing a country's Gross Domestic Product (GDP), as illustrated in the GDP formula.

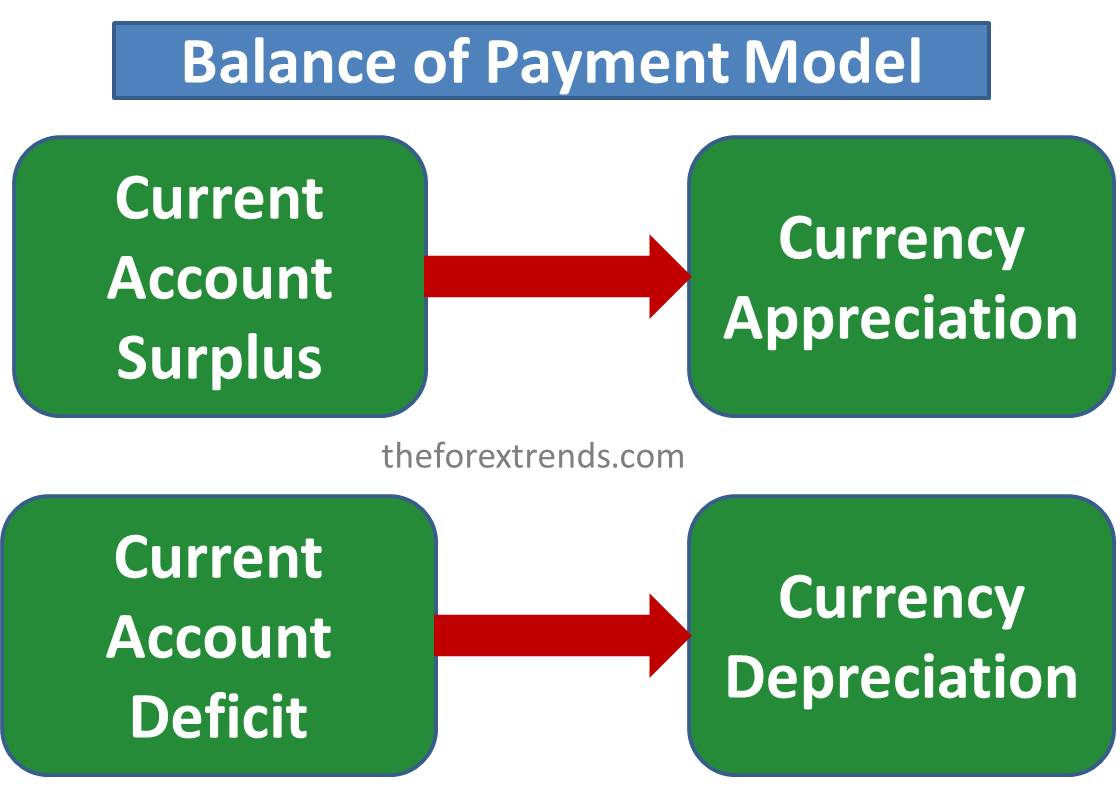

When a country exports more than it imports, it results in a trade surplus, whereas a trade deficit occurs when a nation imports more than it exports. While a trade surplus is generally advantageous for an economy due to the increased job opportunities generated by heightened exporting activities, its impact on a currency's value depends on the market's expectations. Similarly, a trade deficit doesn't always have negative consequences for a currency. Refer below image to understand the balance of payment model.

Broadly speaking, a widening trade surplus or a shrinking trade deficit tends to strengthen a currency. Conversely, a shrinking trade surplus or a widening trade deficit typically leads to currency depreciation.

Countries with a trade surplus usually boast a stronger currency relative to others because there is heightened demand for their currency. This stems from the need for foreign buyers to exchange their local currency for the surplus country's currency. In the investment realm, countries with consistent trade surpluses tend to attract more investors. For instance, emerging markets such as China become appealing investment destinations due to their consistent trade surpluses over recent years.

Countries have the authority to impose tariffs and trade barriers on imports to bolster domestic manufacturing, support local businesses, and reduce trade deficits. However, this strategy can sometimes lead to trade wars between nations. Despite good intentions, trade wars often result in unintended negative consequences for the local economy. Consumers are forced to spend more on domestically produced goods and services, causing financial strain.

As of the current date, China has witnessed a significant surge in exports, even amidst the U.S.-China trade tensions. Lockdowns imposed by Western countries in response to the pandemic, coupled with stay-at-home orders, have fueled online shopping, contributing to China's export growth.

The United States has consistently experienced a trade deficit over the years, reaching a 14-year high at the time of writing. While Americans purchasing goods from abroad plays a role in this deficit, it can also be attributed to reduced spending on U.S. goods and services compared to those of other countries.

To make meaningful comparisons of current account balances between different countries, it's helpful to refer to the current account-to-GDP ratio.

In summary, the trade balance, a key economic indicator, reflects the difference between a nation's exports and imports. It can significantly impact GDP and currency values. Trade surpluses and deficits have complex effects on economies and currencies, and countries often resort to trade policies to influence these balances, although these measures can lead to unintended consequences like trade wars. Understanding the trade balance is vital for assessing a country's economic health and its position in the global economy.

I hope this article is helpful for you in understanding the Economic Indicator: Trade Balance of a Country.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments