THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss the Economic Indicator: Retail Sales - A Key Driver of Economic Health.

When it comes to understanding the health of an economy, one crucial metric that stands out is retail sales. It's not just a number on a report; it's a powerful indicator that can significantly impact various aspects of the financial world. In this article, we'll explore the significance of retail sales, how it affects the economy, and its broader implications.

As we've previously discussed, consumer consumption plays a monumental role in driving GDP growth. In fact, it accounts for a substantial 70-80% of GDP. An increase in retail sales is generally seen as positive for a country's currency, while a decline can have the opposite effect. Why? Because consumer spending directly influences the overall state of the economy. If consumers tighten their wallets and reduce spending, it can hit the economy hard.

The number of people employed has a direct bearing on consumer confidence, which in turn affects retail sales. When more people have jobs and feel secure about their financial prospects, they are more likely to spend money. Conversely, high unemployment rates can lead to reduced consumer confidence and, subsequently, lower retail sales.

To get a more accurate picture, experts often look at core retail sales. This metric excludes automobile sales, which can skew the numbers due to their high value. Since retail sales reflect consumer spending, they also influence GDP announcements. Therefore, the impact of retail sales extends to the stock market, capital flow, and currency values, much like GDP reports.

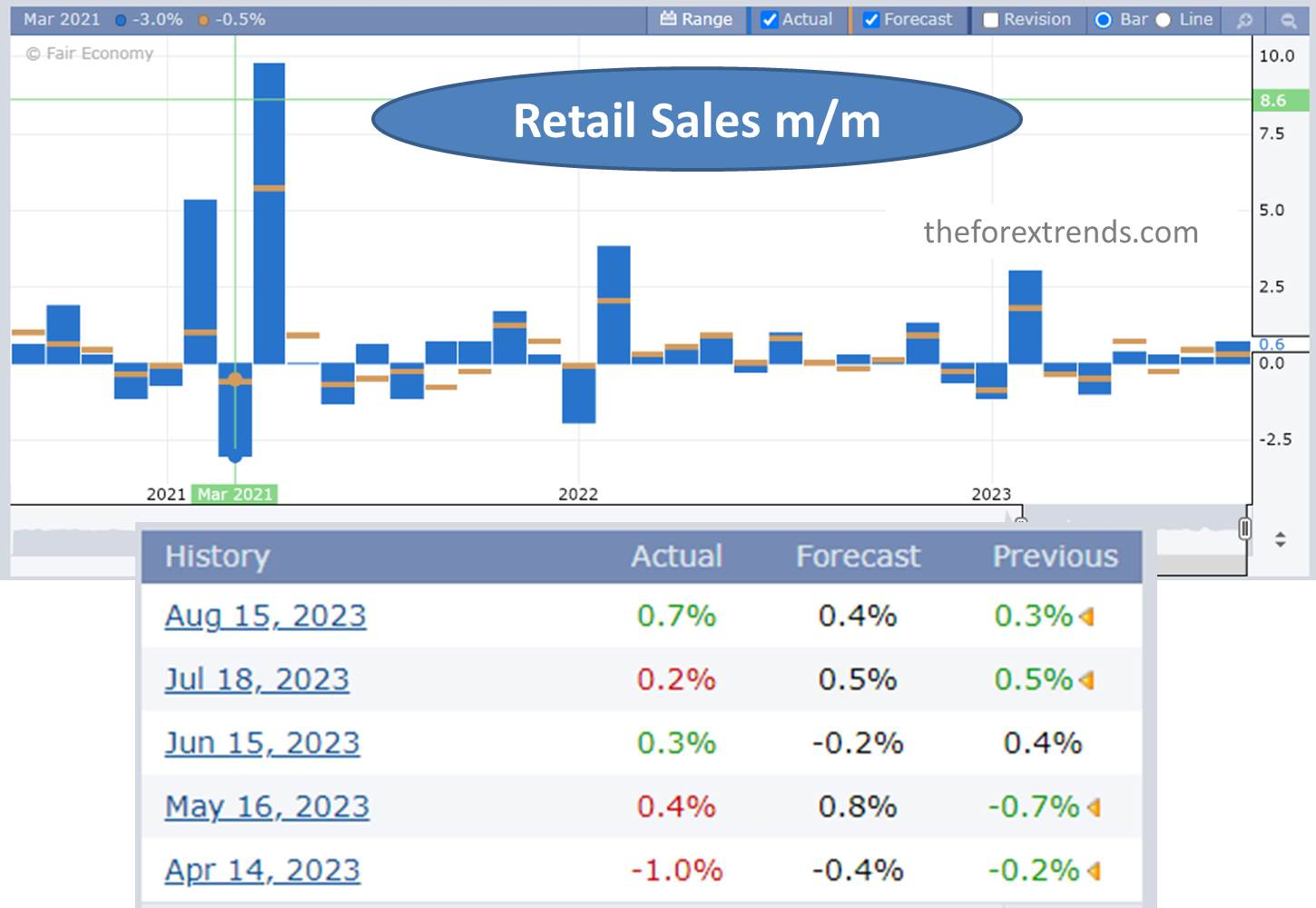

It's crucial to focus on trends and expectations rather than fixating on specific figures when analyzing retail sales. Seasonal factors heavily influence retail sales, with holiday spending, for instance, giving them a significant boost. Relying solely on a single month's data can lead to inaccurate conclusions.

If retail sales surge too drastically, it may not bode well for the U.S. dollar. The United States heavily relies on imports, and a sharp increase in retail sales can contribute to inflation spiraling out of control. This situation might prompt the Federal Reserve to consider raising interest rates, impacting currency values.

While retail sales offer valuable insights into consumer spending, another measure to watch is the Personal Consumption Expenditures (PCE). This metric considers durable goods, non-durable goods, and services in its assessment of consumer spending patterns.

In conclusion, retail sales are not just numbers; they are a window into a nation's economic health. By understanding their significance and the broader implications they hold, investors, economists, and policymakers can make more informed decisions in the ever-evolving financial landscape.

I hope this article is helpful for you in understanding the Economic Indicator: Retail Sales - A Key Driver of Economic Health

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments