THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss the Economic Indicator: Services PMI.

Services PMI, also known as the non-manufacturing PMI, is a vital economic indicator that may not grab headlines like some other indicators I've talked about earlier. This economic gauge is provided by the Institute for Supply Management (ISM).

What it does is pretty straightforward. It takes a survey to assess how well things are going in the services sector, which includes things like restaurants, healthcare, and other non-manufacturing industries. Unlike manufacturing, services tend to be less influenced by economic ups and downs.

But here's the catch: if the actual results from the survey are quite different from what people were expecting (the consensus), it can cause some big waves in the financial markets. Surprisingly, even though the services sector contributes a larger chunk to the U.S. GDP compared to manufacturing, investors and traders treat them equally.

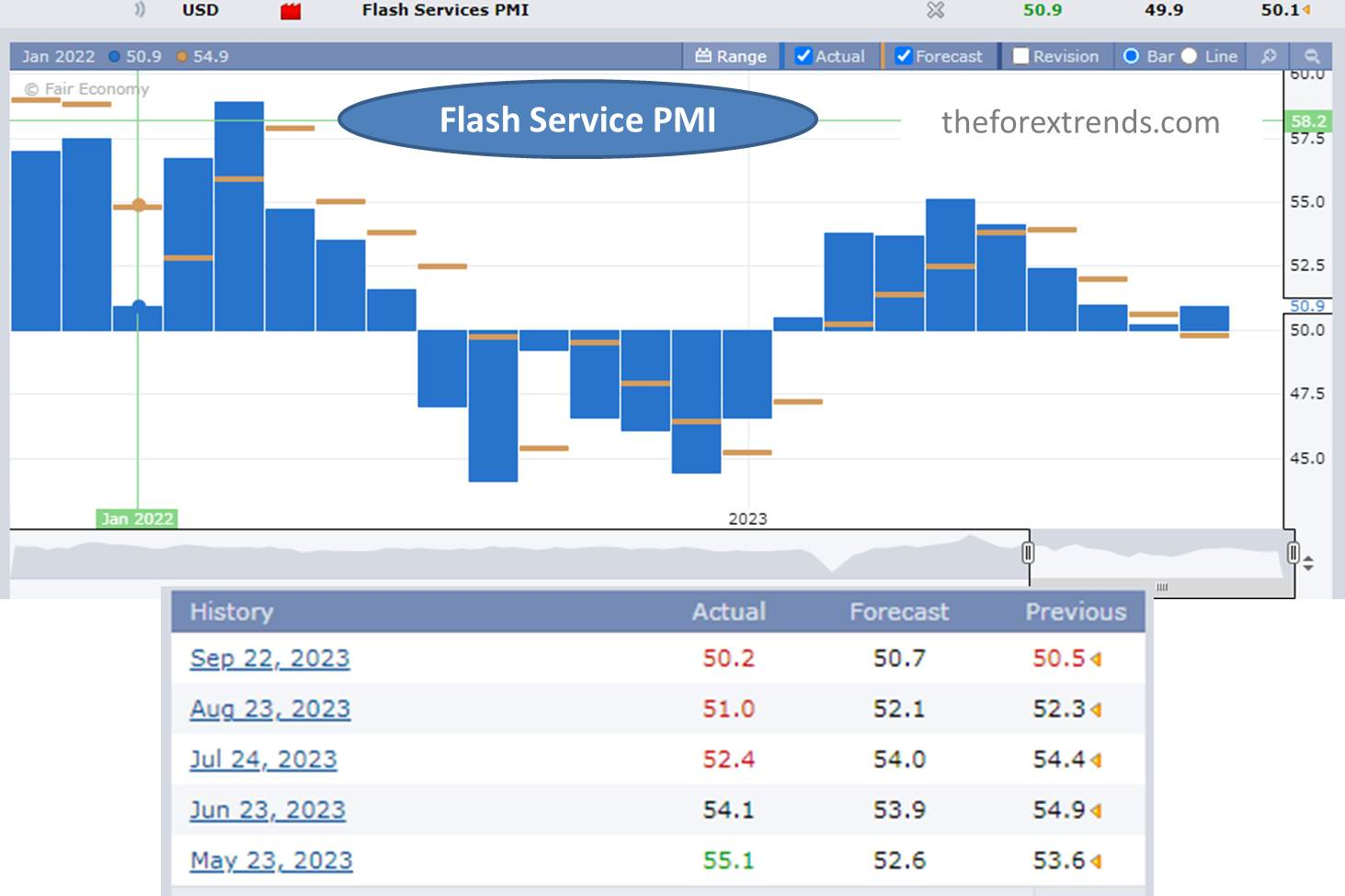

Here's where it gets interesting. Services PMI is a great way to predict the future GDP growth percentage. When the value is above 50, it means the economy is growing, and when it's below 50, it's contracting. Looking at the past few years, the services sector had been doing well with periods of growth and occasional minor slowdowns, until the pandemic hit and everything slowed down. You can refer below figure for Services PMI data of USA.

Now, let's shift our focus to money supply. After understanding all these economic indicators, you can better grasp how much money is circulating in the economy. If you've taken finance classes, you might have heard terms like M1, M2, and M3 money supply. But let's not get lost in the formulas. For now, we'll concentrate on M2 money supply.

M2 includes the money you can easily withdraw and spend. It encompasses things like cash, savings accounts, certain types of deposits (under $100,000), and money market mutual funds. In simple words, it's the money you can readily access.

Keeping an eye on M2 is crucial because it tells us about the amount of money flowing in the economy. Central banks have a big role in managing this money supply through their monetary policies to control inflation. If they increase the money supply, the value of the U.S. dollar tends to decrease, and vice versa. It's all part of the complex dance of economics.

I hope this article is helpful for you in understanding the Economic Indicator: Services PMI ,

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments