THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss inflation and deflation in the economy.

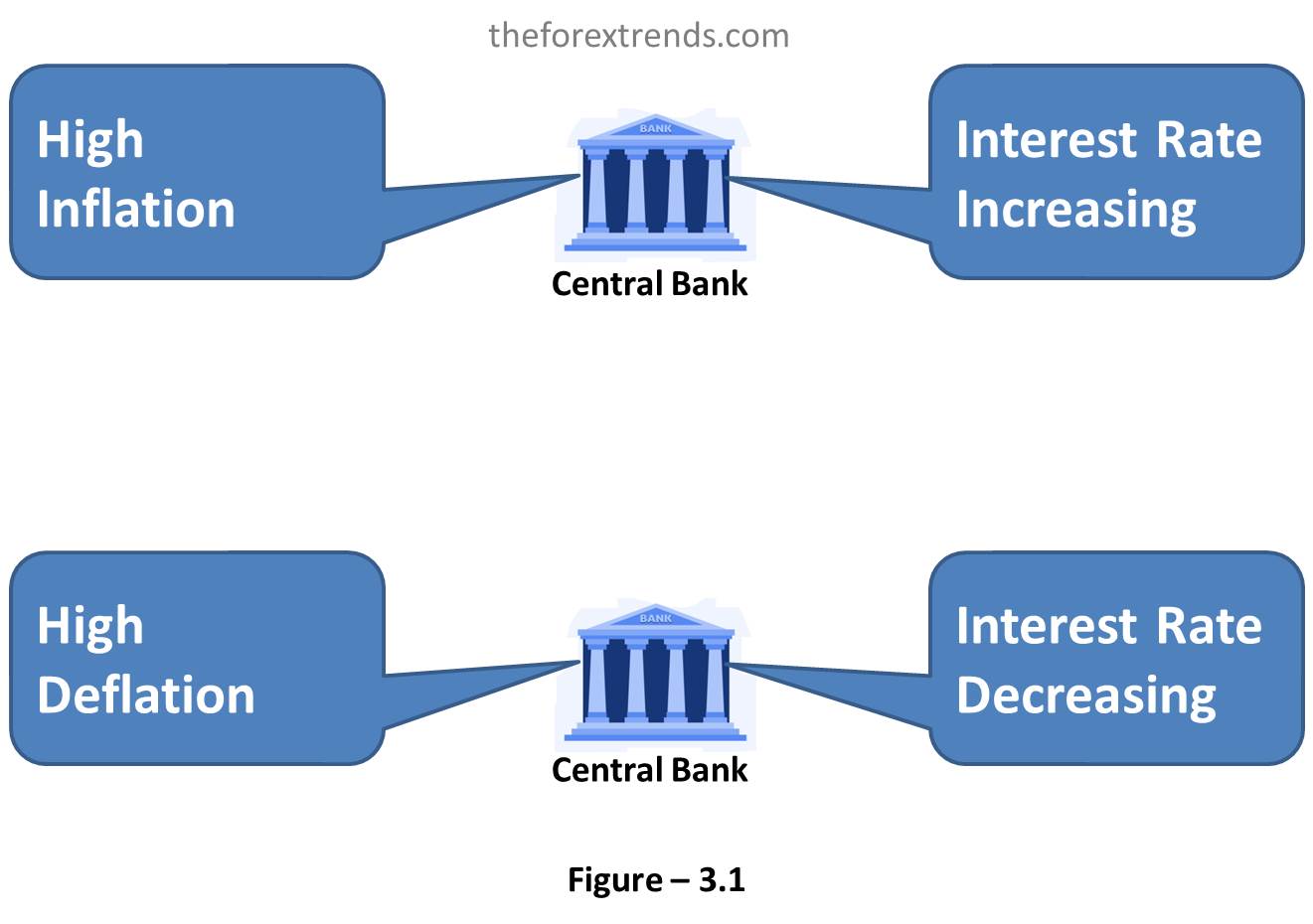

Inflation and deflation are both economic terms that describe changes in the general price level of goods and services in an economy. They represent opposite movements and have different implications for the overall economy. Central banks of countries are constantly intervening (Refer to Figure – 3.1) to control inflation as well as deflation to maintain price stability.

Whenever the overall price of products and services rises, it is claimed that inflation is rising as well. It measures how much the normal rate of prices on goods and services increases over spending over a certain time. When we have too much money chasing fewer goods and services, it is a symptom of inflation. Often Central banks intervene to avoid an extreme increase in inflation, because as the cost of goods and services rises, so does the value and the purchasing power of the currency fall. That means consumers and businesses can purchase a few since the rice. All central banks of the world have a mandate to keep the inflation level at a certain level. For Forex trading commonly inflation is assessed by economic indicators such as the consumer price index (CPI) and the Producer price index (PPI).

If the amount of money in circulation increases faster than the production of goods and services, it can lead to inflation.

When aggregate demand in an economy outpaces the supply of goods and services, it can result in inflation as consumers compete for limited resources.

If the production costs for businesses increase, they may pass on those costs to consumers in the form of higher prices, leading to inflation.

As prices rise, consumers may find it more difficult to afford the same quantity of goods and services.

Inflation can affect different individuals and groups in various ways, redistributing purchasing power between borrowers and lenders or between fixed-income earners and others.

High inflation can create uncertainty in the economy, making it challenging for businesses and individuals to plan for the future.

Logically, deflation is the opposite of inflation it happens when prices of goods and services are falling. Deflation is when too little money is chasing too many goods and services. At times, deflationary forces can hit the labor market fairly hard by increasing the unemployment level as the overall demand in the economy decreases. On the other hand, deflation makes it more affordable to struggling consumers items such as food, fuel, and core consumable items. Deflation is less common than inflation and can have significant impacts on the economy.

If the money supply decreases or if there is a decrease in the velocity of money (the rate at which money circulates in the economy), it can lead to deflation.

When consumer spending declines, businesses may lower prices to stimulate demand, resulting in deflation.

Rapid advancements in technology can lead to increased productivity and lower production costs, causing prices to fall.

Falling prices mean that consumers can buy more goods and services with the same amount of money.

When consumers expect prices to continue falling, they may delay purchases, leading to reduced demand and potentially harming the economy.

It's important to know that moderate inflation is generally considered desirable for economic health, as it indicates a growing economy. On the other hand, deflation can be a sign of economic slowdown or recession and is often seen as undesirable.

I hope this article is helpful for you to understand Inflation and deflation in the economy.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments