THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

This article will explain the Factors Impacting Economic Indicator Significance.

Recognize that economic indicators' importance fluctuates over time due to shifts in a nation's economic landscape and political climate. What's significant in the market today might not hold the same weight in the future. Several factors influence the significance of economic indicators:

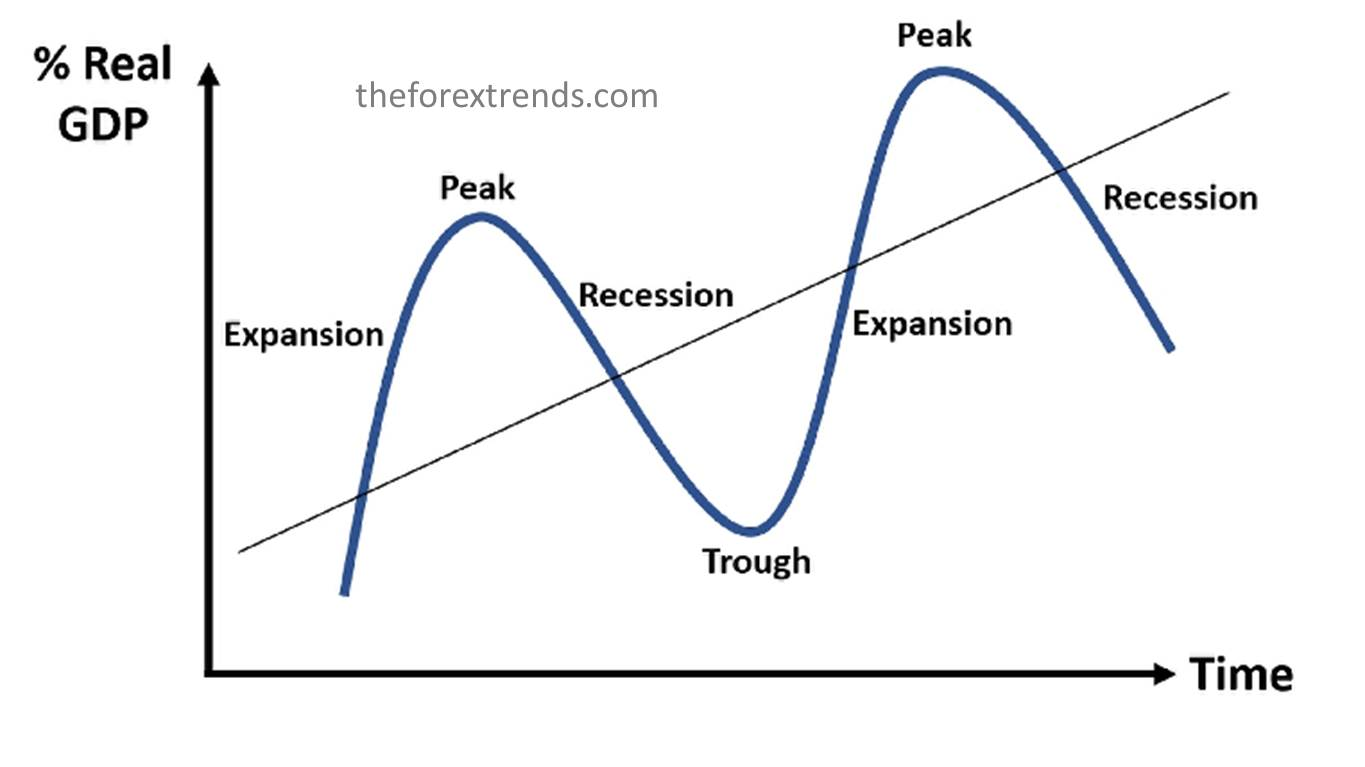

The economy moves through phases like expansion, peak, recession, and trough in a continuous cycle. At different stages, markets pay attention to varying economic indicators. For instance, during an economic boom (expansion phase), markets focus on inflation numbers. In a recession, attention shifts to employment and unemployment figures.

Economic indicators often undergo revisions. Take Gross Domestic Product (GDP) data, for example; it is released in three stages: Advanced, preliminary, and final. Surprisingly, markets react more to the initial release (advanced GDP) despite its lower accuracy compared to the revised preliminary and final data. Market behavior suggests a preference for early information over precision. However, even revised figures are not entirely accurate, as no economic indicators are flawless. Additionally, there may be conflicts of interest in forecasting these numbers. GDP also fails to account for second-hand sales, underground transactions, and free services, leading to an underestimation of a country's true economic activity.

The larger a country's economy, the more significant its data releases become. This explains why traders and investors closely monitor U.S. economic data compared to indicators from smaller economies.

Understanding statistics is crucial here. If a survey's sample size is too small, the resulting data will lack accuracy and representativeness. New economic indicators without historical data generally don't have a significant market impact because traders aren't familiar with them.

There are numerous economic indicators to consider, each tracking different aspects of the market's economic drivers. These include indicators monitoring overall economic health, housing markets, manufacturing industries, employment trends, inflation rates, consumer behavior, interest rates, and international trade activities. Keep in mind that different countries prioritize different economic drivers. We'll discuss the indicators most commonly deemed important across nations in our next articles.

I hope this article is helpful for you in understanding the Factors Impacting Economic Indicator Significance.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments