THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss Exploring Economic Indicators: Your Path to Smart Trading on Forex.

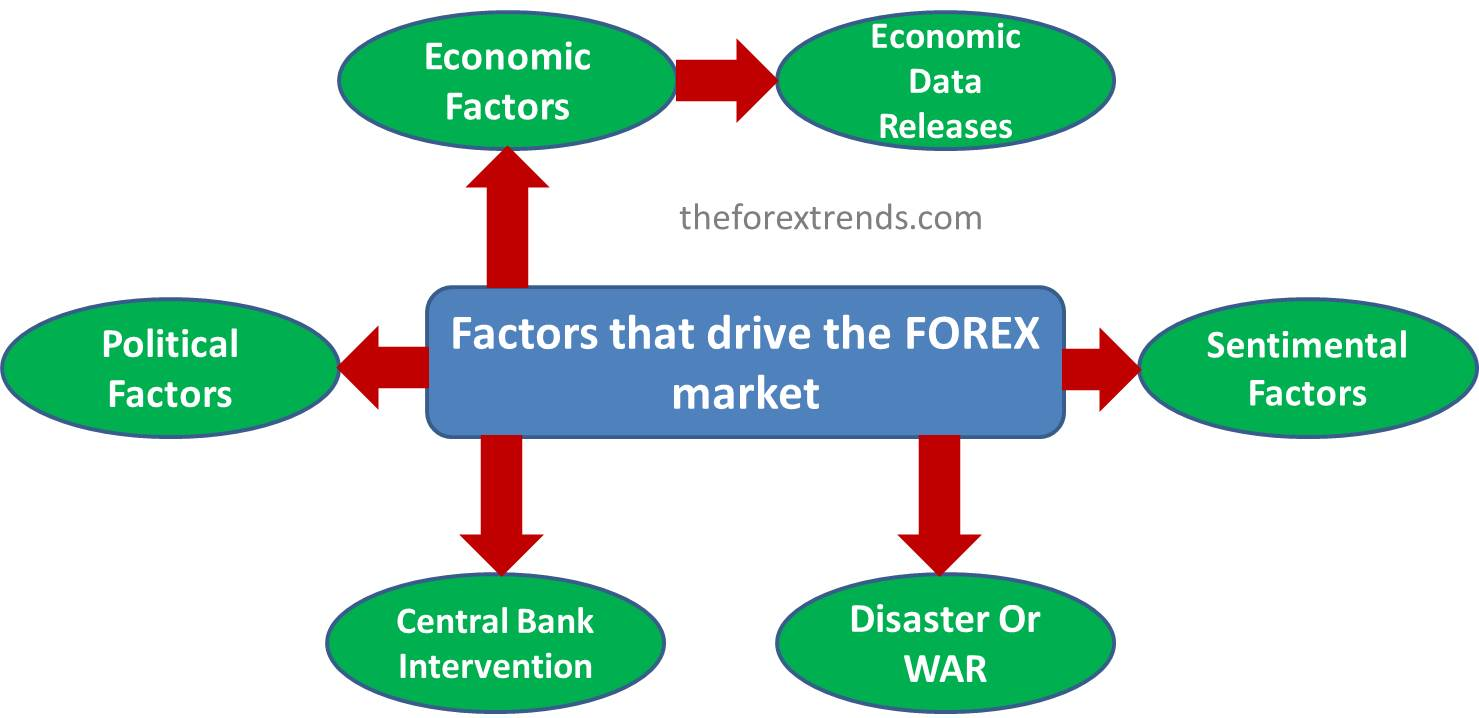

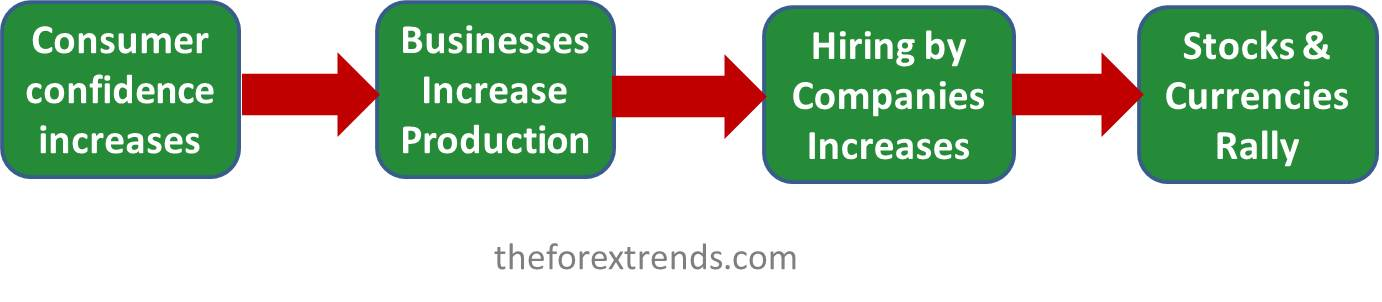

In the world of finance, various factors can set the wheels of the market in motion. Among these, economic data releases stand out as game-changers. These economic indicators not only paint a picture of a nation's economic health but also offer insights into the potential future decisions of central banks regarding interest rates. Why should you care about these indicators? Well, for starters, they form the bedrock of long-term market movements. Moreover, major players like central banks, hedge funds, and governments rely on these indicators to shape their strategies. When the experts trust these indicators, it's a good reason for you to pay attention too.

Every central bank has its unique objectives, but they all share a common goal: to maintain price stability and foster economic growth. To make sound policy decisions, they scrutinize economic indicators to gauge the current state of the economy. So, whether you're a professional or a novice, understanding economic indicators is key.

Now, let's simplify things a bit. It's not just about the raw numbers; it's about expectations. Market reactions are based on how actual results compare to consensus forecasts. If the real data matches expectations, the market usually remains steady. But if it deviates significantly, brace yourself for some market turbulence. Accuracy concerns aside, markets react to what's in front of them, not the underlying data quality.

To gain a clear perspective, zoom out and look at the bigger economic picture over the past 12 months or more. Comparing the current month's data to previous months gives you insights into trends. Visualizing these trends through line charts can be invaluable.

Economic indicators come in different flavors: low-impact, medium-impact, and high-impact. Focus on high-impact ones, but don't disregard the rest. If a surprise data release strays far from consensus, it can still move markets as it wasn't factored in.

Today, economic calendars are your best friend. They summarize economic events over specific periods. But remember, relying on a single indicator for a long-term economic view doesn't cut it. Currency markets are driven by a constellation of these indicators, working together to influence conditions.

Start small, study one to three indicators for a couple of months, and observe their short and long-term market impacts. Sometimes, indicators may give mixed signals. To navigate this, create a scoring system to gauge an overall fundamental bias. Excel sheets and graphs can help with this.

Economic indicators fall into three categories: leading, lagging, and coincident. Leading indicators predict the future, lagging indicators describe the past, and coincident indicators reflect the present. Some indicators move in sync with the economy (like GDP), while others move in the opposite direction (e.g., unemployment rates).

To master economic indicators, deliberate practice, and critical thinking are key. Try making your own predictions before data releases. Even if you're wrong, you'll gain valuable insights. And don't just wait for monthly data releases—proactive learning beats passive waiting.

I hope this article is helpful for you in understanding Exploring Economic Indicators: Your Path to Smart Trading on Forex.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments