THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

This article will explain the Concept of Monetary Policy and its influences on the Forex market

.

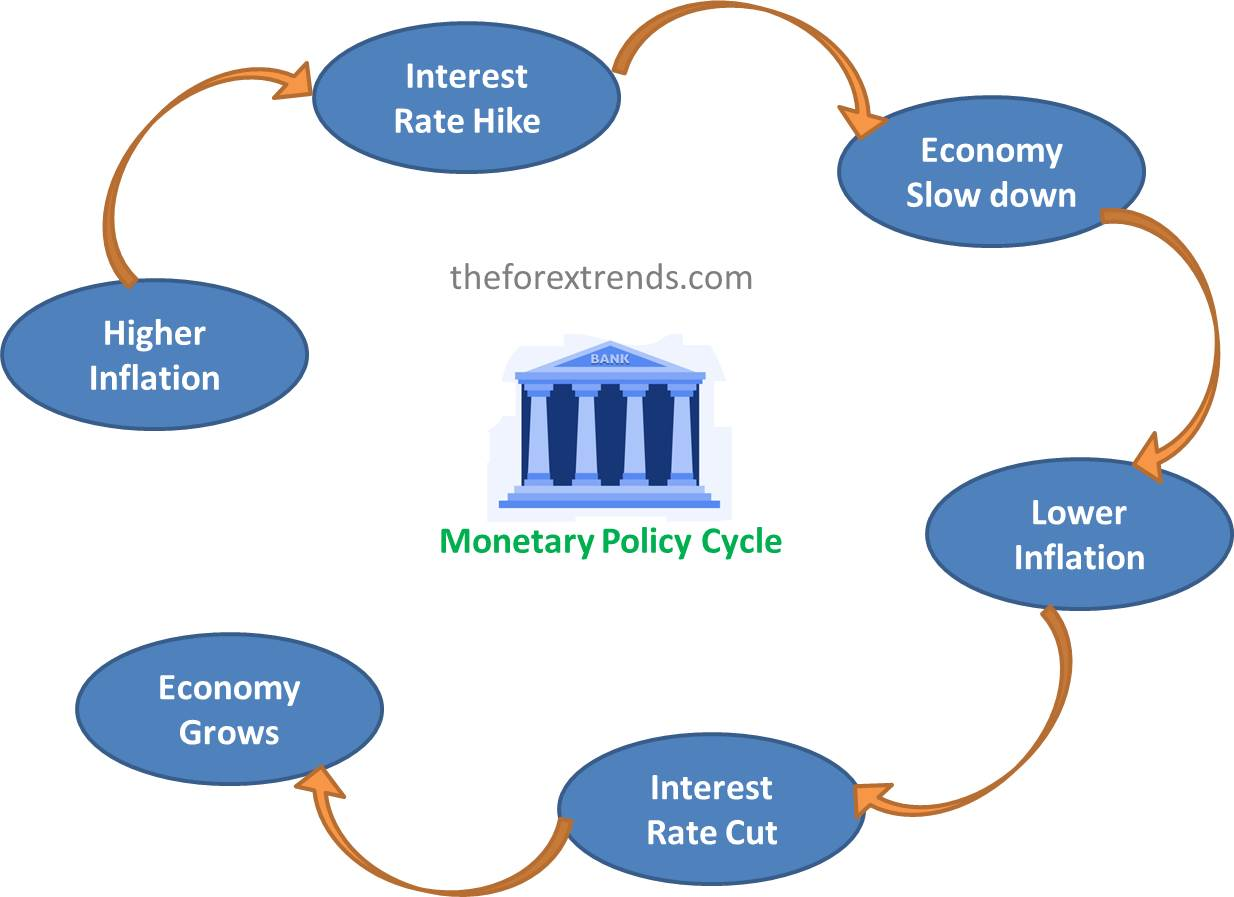

Monetary policy refers to the actions and strategies employed by a central bank of a respective country to regulate the money supply, interest rates, and credit conditions in an economy. While monetary policy primarily aims to achieve domestic economic objectives, its implementation has a profound impact on the currency market. There are two types of monetary policy:

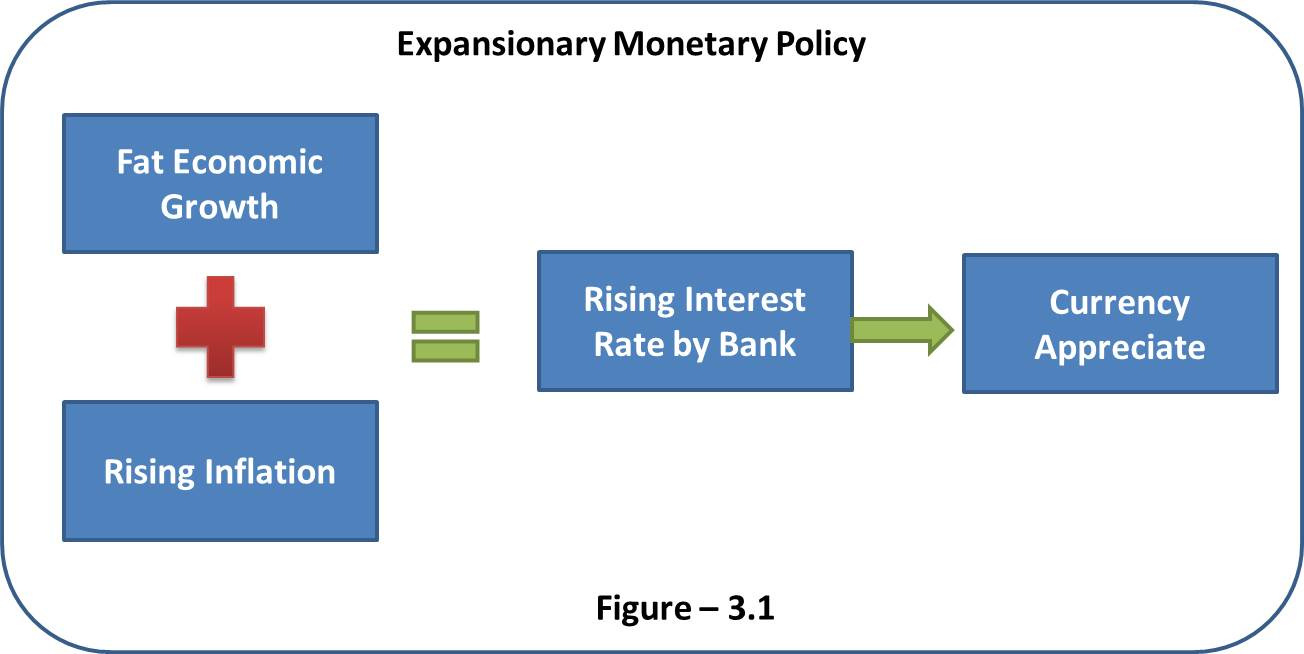

During rising unemployment periods and low economic growth, such as recession, central banks will increase the money supply by cutting interest rates or using other tools. This action taken by the central bank is known as expansionary monetary policy. In 2008 the Fed cut interest rates to all-time lows to stimulate the U.S economy when recession looms in U.S. Refer to Figure 3.1 to understand the impact of this policy.

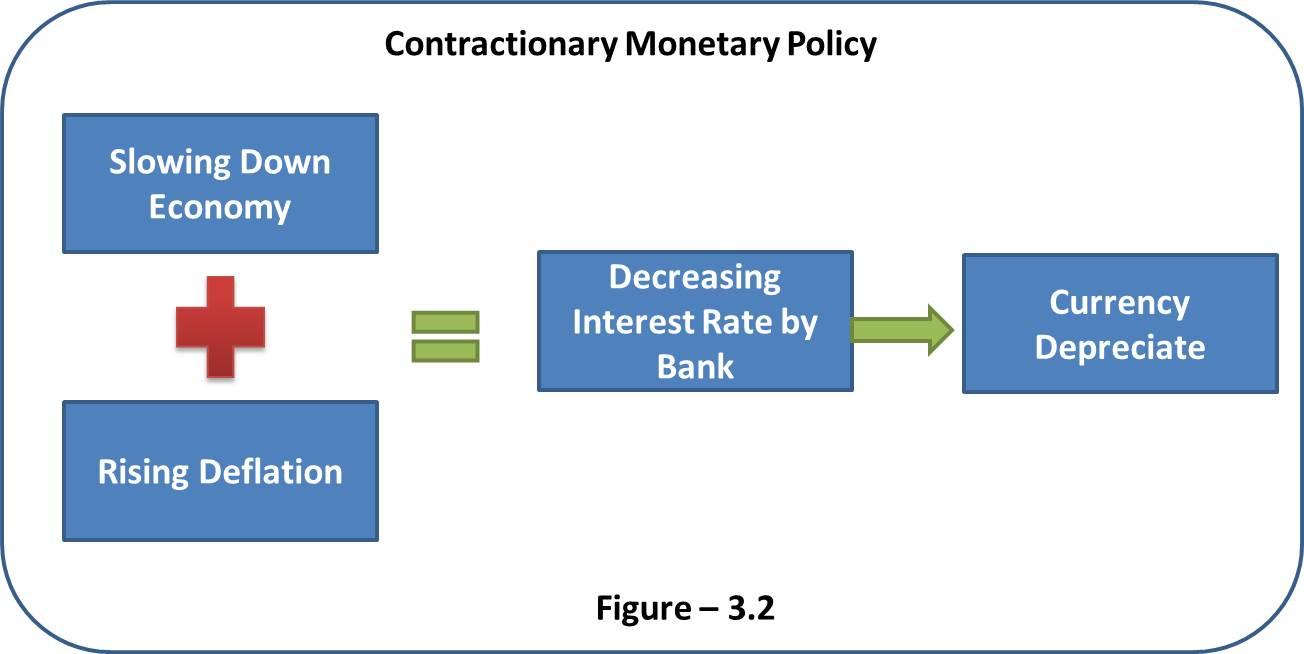

During high economic growth periods and rising inflation, the central bank will implement more restrictive monetary policies. To reduce the money supply to the economy central bank will increase interest rates or use other tools. This action taken by the central bank is known as Contractionary monetary policy. This type of policy is also used to correct the trade deficit of the country. The reason for the trade deficit is the excessive consumption of imported items. Refer to Figure 3.2 to understand the impact of this policy.

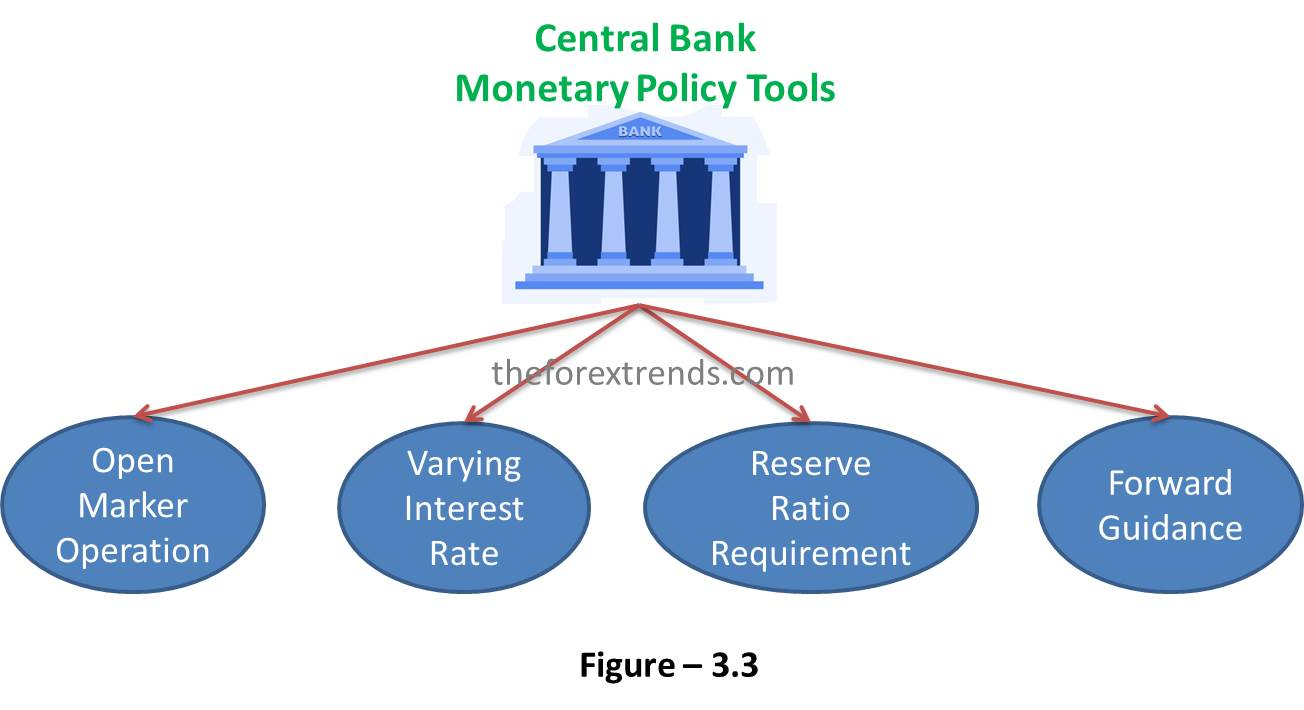

Some of the monetary policy tools used by central banks of any country include Setting reserve ration requirements, conducting Open market operations, varying Interest rates, Forward guidance etc. These tools are used for both type of monetary policy.

Money supply can also be influenced by setting the reserve ratio requirements. Banks must keep a certain amount of deposits in the form of liquid cash, with the rest being lent out to borrowers. For instance, if the reserve ratio requirement is 30%, the bank can lend out 70%. Lower reserve requirements allow banks to lend out more funds, which leads to an increase in money supply to the economy. Reduces reserve requirements can potentially lead to domestic currency depreciation.

It is a monetary policy tool that involves buying and selling government securities by Govt. body to influence the money supply and interest rates. By buying back these govt. securities, the money supply will increase in the economy, leading to a decrease in interest rates. This is known as expansionary open market operation. By doing the opposite, the money supply will decrease, leading to an increase in interest rates. This is known as a deflationary open market operation.

It is a very crucial component of monetary policy. The board members of Governments have the responsibility to adjust the interest rate as per requirement. If interest rates are increased, it becomes more expensive for businesses to borrow, which leads to a decrease in the money supply in the economy. As we are currency traders, it is required to note that increased interest rate will cause the domestic currency to appreciate, and vice versa.

Central banks provide forward guidance through official statements, press conferences, and publications to communicate their future monetary policy stance and intentions. Market participants closely monitor these communications as they can significantly impact exchange rates and market expectations. For example, if a central bank hints at future interest rate hikes, it may strengthen the currency in anticipation of higher yields.

It is important to continuously monitor and analyze the impact of monetary policy decisions on exchange rates to make informed decisions in the Forex market.

I hope this article is helpful for you in understanding the Concept of Monetary Policy and its influences on the Forex market.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments