THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss the Economic Indicator: Consumer Confidence and Sentiment.

Consumer Confidence and Sentiment are economic metrics that gauge how optimistic people are about the economy, both presently and in the future. Two key measures of consumer sentiment are the Consumer Confidence Index (published by The Conference Board) and the University of Michigan Consumer Sentiment Index.

The University of Michigan Consumer Sentiment Index can provide insight into future consumer spending behavior. When consumers feel more confident about their job security and income prospects, they tend to spend more.

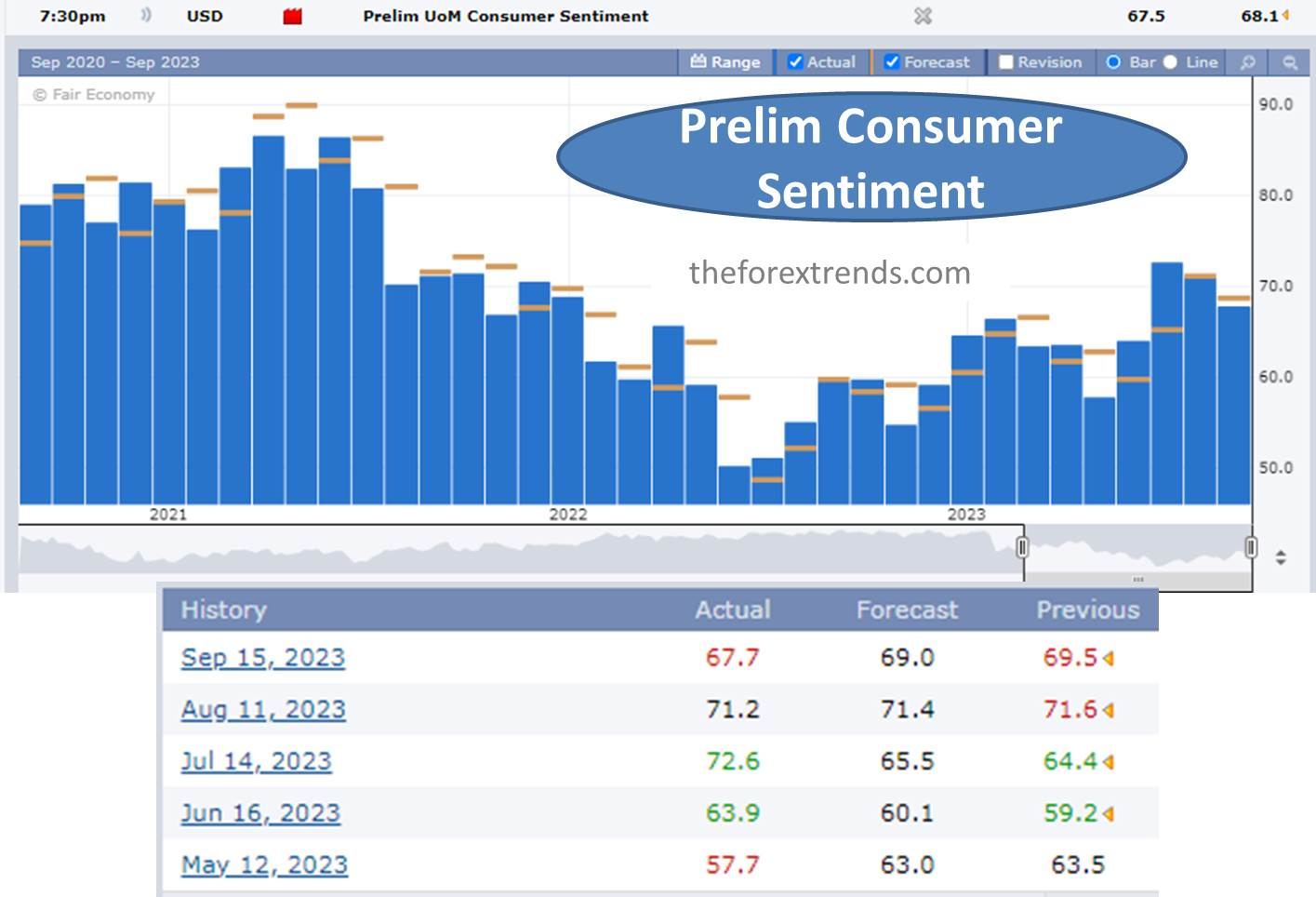

It's worth noting that the University of Michigan Consumer Sentiment Index is issued in two forms: a preliminary report and a final report, which is revised later. The initial release often has a more significant impact than the final one.

The Consumer Confidence Index (CCI) is another measure of consumer confidence. It assesses inflation expectations and confidence in business conditions.

Why is consumer confidence so crucial? Firstly, consumer spending drives over half of the United States' economy. Secondly, influential entities like hedge funds, policymakers, and economists closely monitor this indicator when making decisions.

Increased consumer confidence can potentially lead to higher U.S. interest rates and greater investment in the stock market. As foreign investors pour money into the stock market, the demand for the U.S. dollar rises.

Conversely, if consumers are pessimistic about their job and business prospects, it can weaken the economy. This leads to capital flowing out of the U.S. stock market in search of higher returns, which can weaken the U.S. dollar. To assess net foreign investment into the U.S., you can refer to the Treasury International Capital (TIC) data, a useful economic indicator for gauging the direction of the USD.

Consumer sentiment indicators are influenced by various factors and can be quite volatile, especially during crises. As expected, the 2020 pandemic resulted in a significant decline in consumer sentiment. Generally, recessions tend to dampen consumer sentiment, but there has been a slow recovery since the pandemic's onset.

The advantage of understanding consumer sentiment indicators is that you can use them to confirm investment decisions. If you believe consumer sentiment will improve over the long term, you might explore undervalued consumer discretionary or cyclical stocks. Conversely, if consumer sentiment trends lower, you may consider consumer staple stocks. However, we won't delve deeply into stock-picking in this article, as our focus is on currency trading. So, there you have it - the world of consumer confidence and sentiment, a vital compass in the economic landscape. It's not just numbers; it's a story of optimism, caution, and economic prosperity.

I hope this article is helpful for you in understanding the Economic Indicator: Consumer Confidence and Sentiment.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments