THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss Government Bond Yields and their impact on the FOREX market.

Keep an eye on the yield curve; it's like an economic crystal ball, hinting at the next recession.

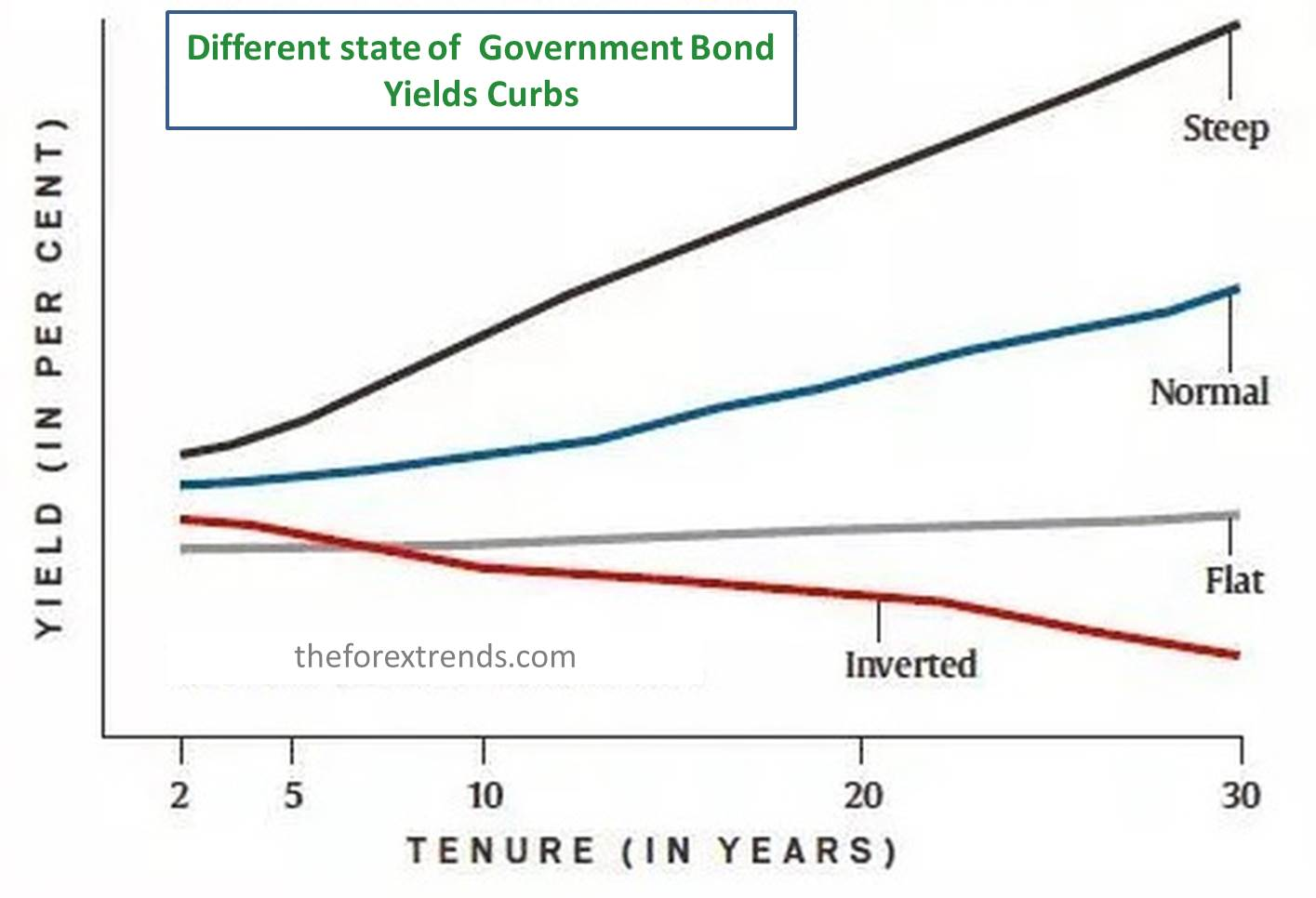

Normally, long-term yields are higher than short-term ones, forming a curve resembling an upward slope. When this happens, we're optimistic about the economy's future. If you're a bond investor, longer-term bonds can bring you better returns thanks to their higher yields. But, be cautious of inflation risk.

Why does the yield curve tilt upward? Well, it's all about investor psychology. When folks invest in long-term bonds, they face various risks like inflation and politics. Naturally, they demand higher returns than what short-term bonds offer. If investors believe that the Federal Reserve is on top of inflation control, they're more likely to buy long-term bonds for those extra yields. However, if they doubt the Fed's efficiency, they lean toward short-term bonds.

When investors anticipate high future inflation, they steer clear of long-term bonds due to the inflation risk. They sell their long-term bonds, causing yields to surge, creating a steep yield curve. In contrast, when long-term yields drop below short-term yields, it could signal an impending recession, making us pessimistic about the economy. History shows that inverted yield curves often precede recessions.

Actions like buying long-term bonds through Quantitative Easing (QE) can flatten the yield curve, another signal of an economic slump. Interest rates aren't just numbers; they're crucial for your analysis. They help in selecting trading pairs and provide insights into the business cycle and market sentiment.

Government bond yields are a key driver of currency movements in the Forex market. Traders and investors closely monitor changes in yields as they provide valuable insights into the economic health, risk sentiment, and monetary policy of a country. By understanding the relationship between government bond yields and Forex rates, market participants can make informed decisions and manage their exposure to currency risk effectively.

I hope this article is helpful for you in understanding Government Bond Yields and their impact on the FOREX market.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments