THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

In this article, we will discuss Economic Indicator: Employment Data.

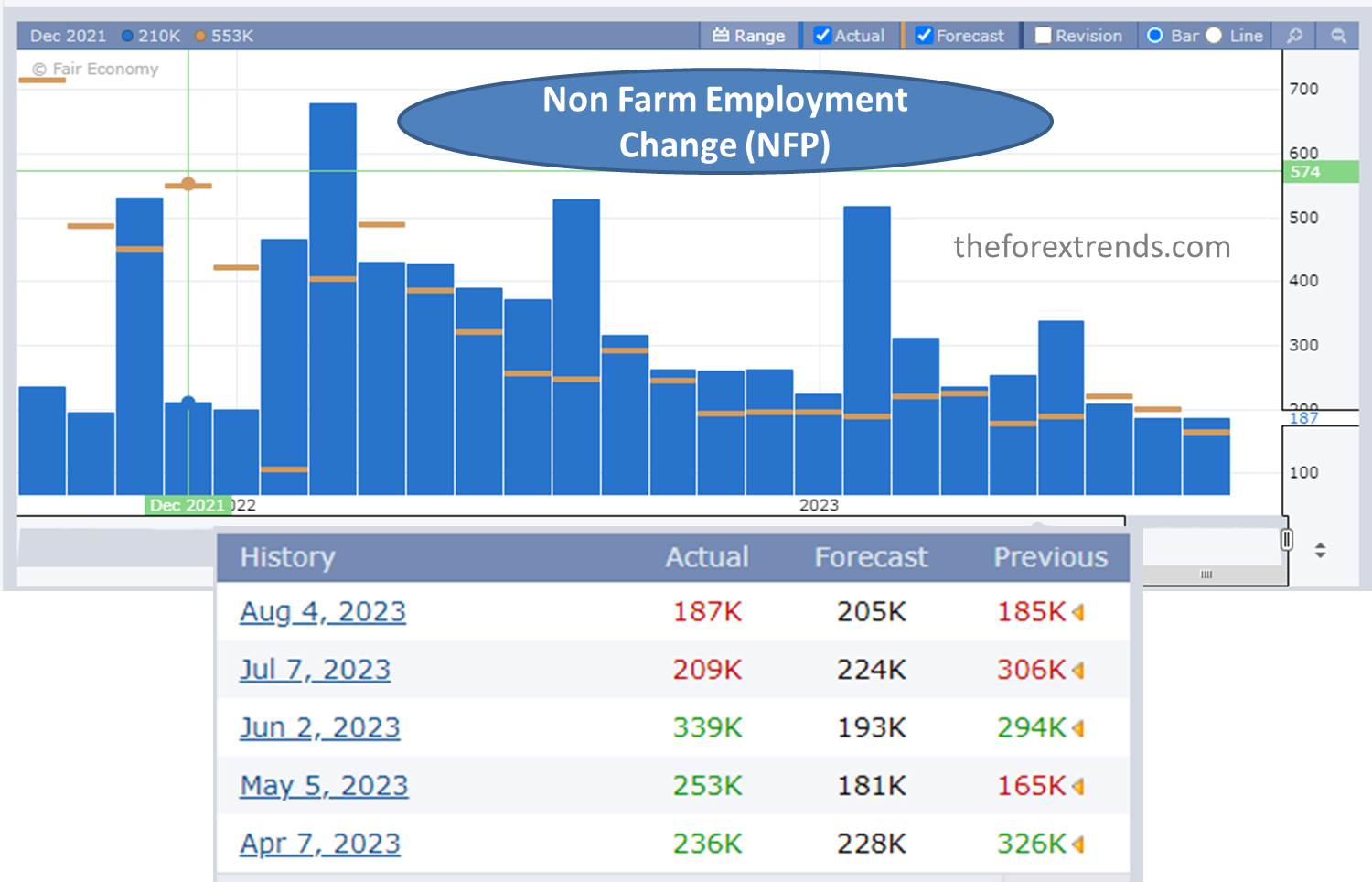

One of the most eagerly anticipated economic indicators is the non-farm payroll (NFP) data, typically unveiled on the first Friday of each month at 8:30 am EST. This data reveals the number of employed individuals, excluding those in agricultural jobs, and holds significant sway over the financial markets. Numerous factors influence employment levels, primarily the interplay of job demand and supply.

he employment data serves as a barometer for the economy's health. A higher number of employed individuals usually signifies a robust economy. This uptick in employment translates to increased consumer spending, leading to businesses expanding their workforce thanks to rising revenue. This ripple effect positively impacts the stock market and the nation's currency value. However, there's a catch—central banks may raise interest rates when the economy overheats to prevent inflation.

Conversely, when job opportunities dwindle, consumer spending weakens, which, in turn, reduces business revenue. This scenario isn't favorable for the stock market or the currency's strength. A high unemployment rate can prompt central banks to lower interest rates, stimulating economic activity. This influx of capital revitalizes the economy but can simultaneously lead to lower yields, encouraging capital to flow out of government debt markets.

To navigate the intricacies of employment data, keep an eye on essential reports: the employment situation report, unemployment insurance weekly claims report, and the ADP National Employment Report.

It's crucial to understand that employment indicators aren't crystal balls for predicting future economic conditions. They are lagging indicators, reflecting the past. Nevertheless, they remain vital for market participants, offering insights into the present economic landscape. Notably, politicians closely track employment levels, knowing that the public often judges their competence based on these figures.

For beginners, a word of caution: Avoid attempting to scalp the NFP numbers without expertise. The high volatility associated with such endeavors can lead to substantial losses. Hedge funds and macro traders, with their seasoned experience, employ employment data as part of a comprehensive analysis to form a long-term perspective on currencies, rather than engaging in short-term scalping.

By mastering the nuances of employment data, you can gain valuable insights into the economic climate and make informed decisions in the financial markets.

I hope this article is helpful for you in understanding Economic Indicator: Employment Data.

Stay tuned to our website for more tutorials about Forex Market. If you have any suggestions or queries, feel free to Contact us or drop your message in the comment section below.

Comments