THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

The Eurozone's Core CPI Flash Estimate for July 2024 has reported an annual increase of 2.9%, slightly surpassing the forecast of 2.8% and matching the previous month's rate. This measure excludes volatile items like food, energy, alcohol, and tobacco, serving as a critical indicator of underlying inflation trends in the Eurozone. The steady inflation rate supports the euro, suggesting moderate inflationary pressure.

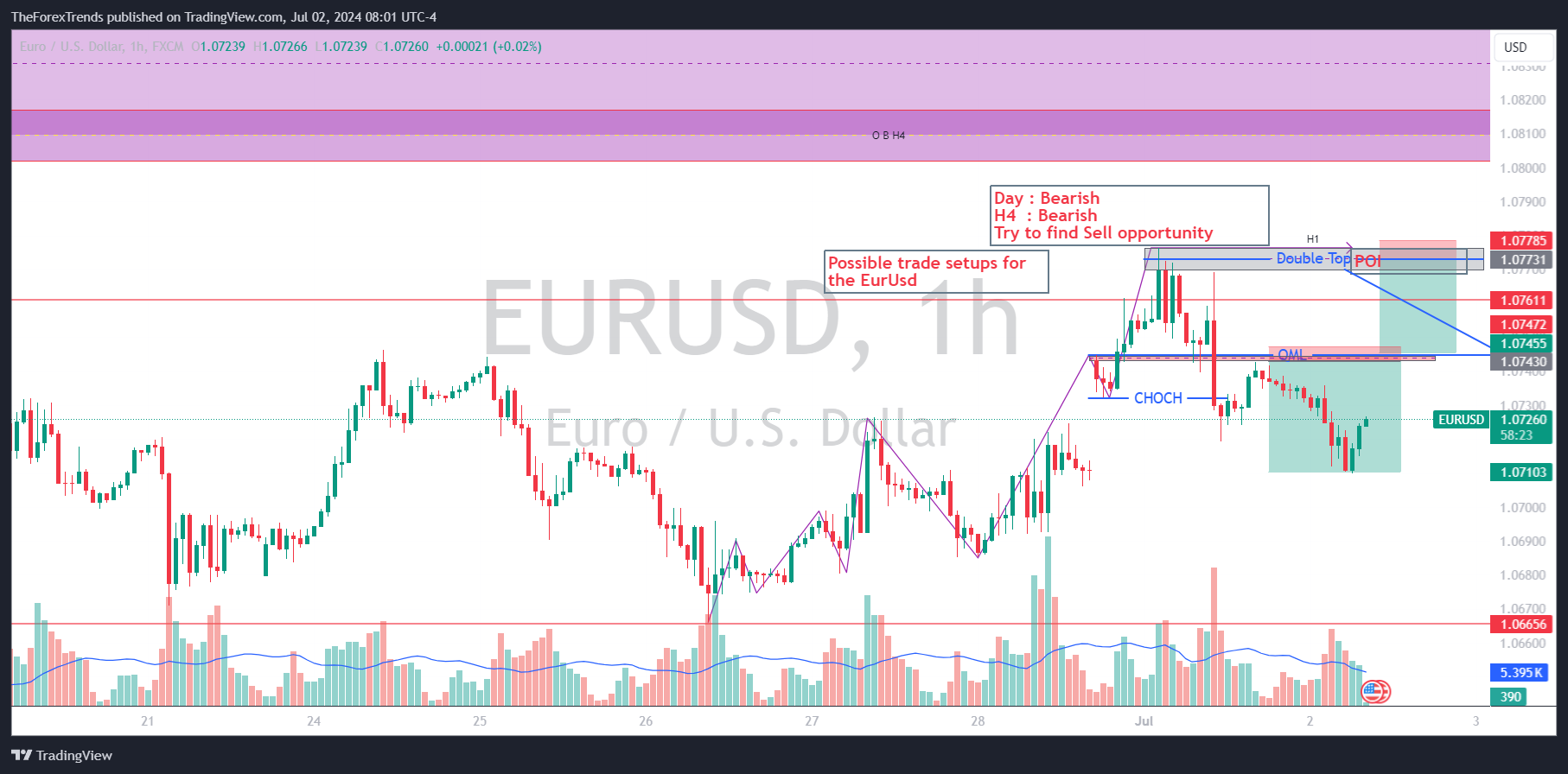

Given the prevailing bearish trend across daily, H4, and H1 timeframes, it's advisable to focus on selling opportunities in lower timeframes while considering these higher timeframe levels.

In summary, maintaining a bearish outlook and looking for short positions at the identified levels of 1.0773 and 1.0745 could yield favourable trading opportunities.

This analysis provides a comprehensive outlook on EUR/USD,. It's essential to perform your own analysis and practice on a demo account before engaging in live trading. The market can be unpredictable, and proper preparation is crucial for success.

Stay updated with our latest analyses and insights into the Forex market. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments