GBP/USD Weekly Analysis based on anticipated news and data releases

Fundamental Overview:

Based on the anticipated news and data releases for next week, the fundamental outlook for GBP/USD will hinge on several key events from both the UK and the US. Here are the crucial data points and events to watch:

United Kingdom:

- Manufacturing and Services PMI:

- Release on: Mid of the week

- Impact: These Purchasing Managers' Index (PMI) reports will provide insights into the health of the UK's manufacturing and services sectors. Stronger-than-expected PMI readings can bolster the Pound, while weaker data can exert downward pressure.

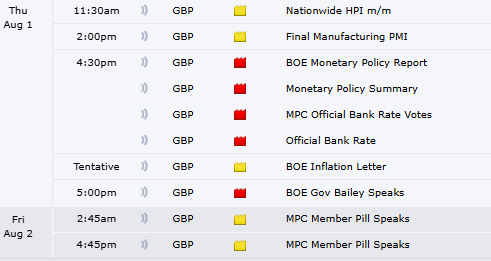

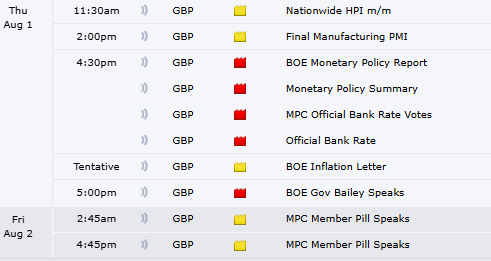

- Bank of England (BoE) Interest Rate Decision:

- Release on: Later in the week

Impact:

The BoE's monetary policy decision is a significant event. Markets will be looking for any signals regarding future rate hikes or dovishness in light of the current economic conditions and inflationary pressures.

United States:

- Non-Farm Payrolls (NFP):

- Release on: End of the week

- Impact: The NFP report is one of the most closely watched indicators in the US. Strong job growth could support the Dollar by reinforcing expectations of further Fed rate hikes, while a weaker report might dampen these expectations.

- Federal Reserve Chair Speech:

- Release on: Mid-week

- Impact: Any comments from the Fed Chair regarding inflation, employment, and future monetary policy will be scrutinized. Hawkish remarks could boost the Dollar, while dovish comments could have the opposite effect.

- Inflation Data:

- Release on: Throughout the week

Impact:

Various inflation metrics, including the CPI and PCE, will be released. High inflation readings could lead to increased expectations of Fed tightening, which would support the Dollar.

Summary of Potential Impacts:

- Positive for GBP:

- Strong UK PMI data.

- Hawkish BoE tone or rate hike.

- Weaker US NFP report.

- Dovish remarks from the Fed Chair.

- Positive for USD:

- Weak UK PMI data.

- Dovish BoE stance or rate hold.

- Strong US NFP report.

- Hawkish remarks from the Fed Chair.

- High US inflation readings.

Given these upcoming events, GBP/USD is likely to experience volatility. Traders should closely monitor these data releases and central bank communications, as they will provide significant direction for the currency pair.

Technical Analysis:

Daily Chart:

Based on my analysis of the daily chart the technical outlook for GBP/USD suggests a potential fresh uptrend, as indicated by recent movements on the daily chart. Here are the key points to consider:

- Key Support Levels:

- 21-day SMA: A daily close below the 21-day Simple Moving Average (SMA) at 1.2851 would reduce the chances of a recovery. The day candle closed above this, so a recovery cannot be ruled out

- Immediate support: The previous resistance level near 1.2800 now serves as immediate support on any renewed downside.

- 50-day SMA: Further south, the 50-day SMA at 1.2777 is the next support level.

- 100-day SMA: If the 50-day SMA fails, the 100-day SMA at 1.2682 would be exposed to sellers.

- Key Resistance Levels:

- Weekly High: Recapturing the weekly high of 1.3045 is crucial for initiating a fresh uptrend.

- Round Figure: Ahead of the yearly high, the 1.3000 round figure is a significant psychological level that will challenge bullish momentum.

The technical indicators and key levels point to a cautiously optimistic outlook for GBP/USD, with the potential for a fresh uptrend if certain resistance levels are overcome while maintaining key support levels to watch on the downside.

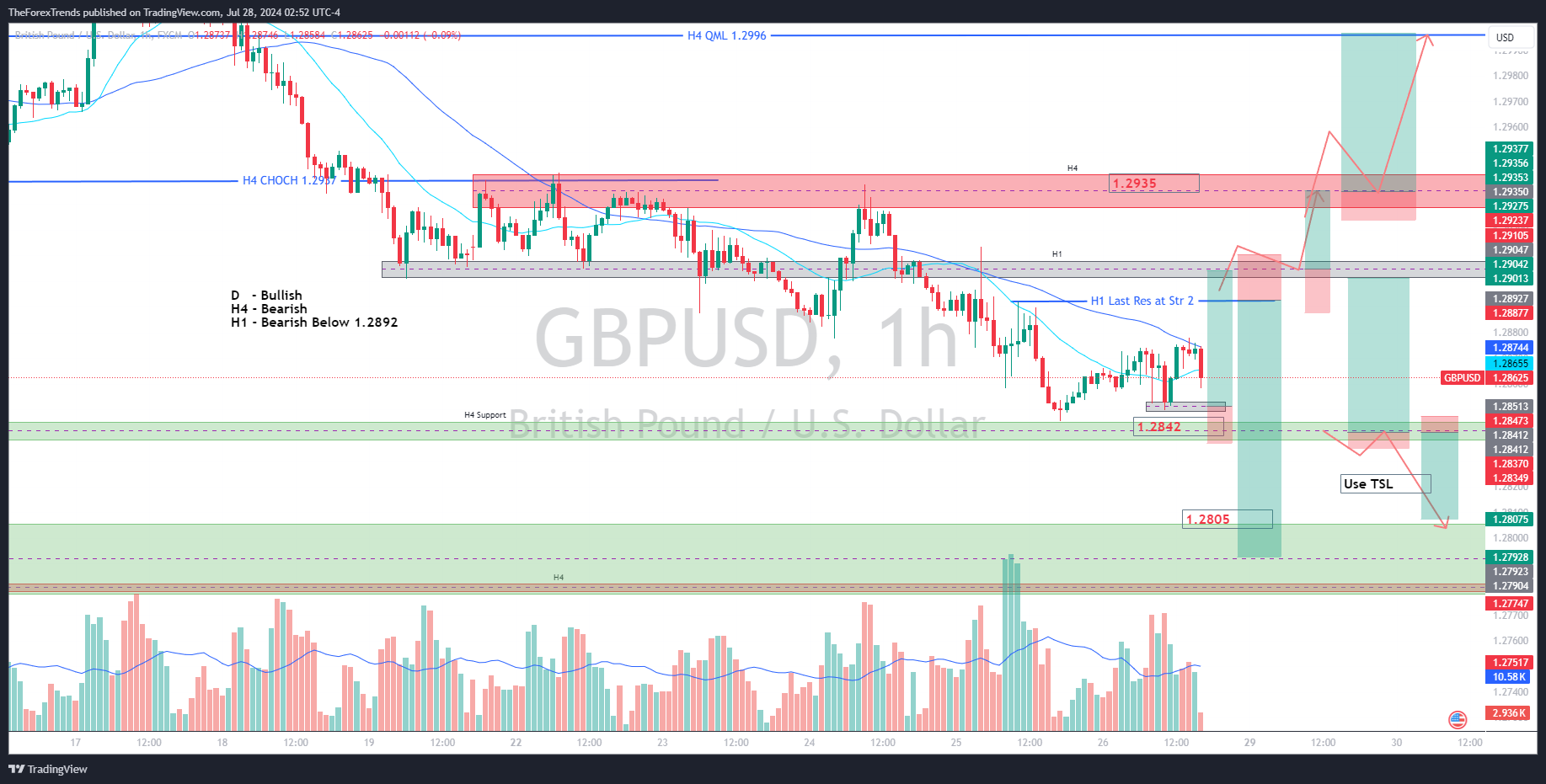

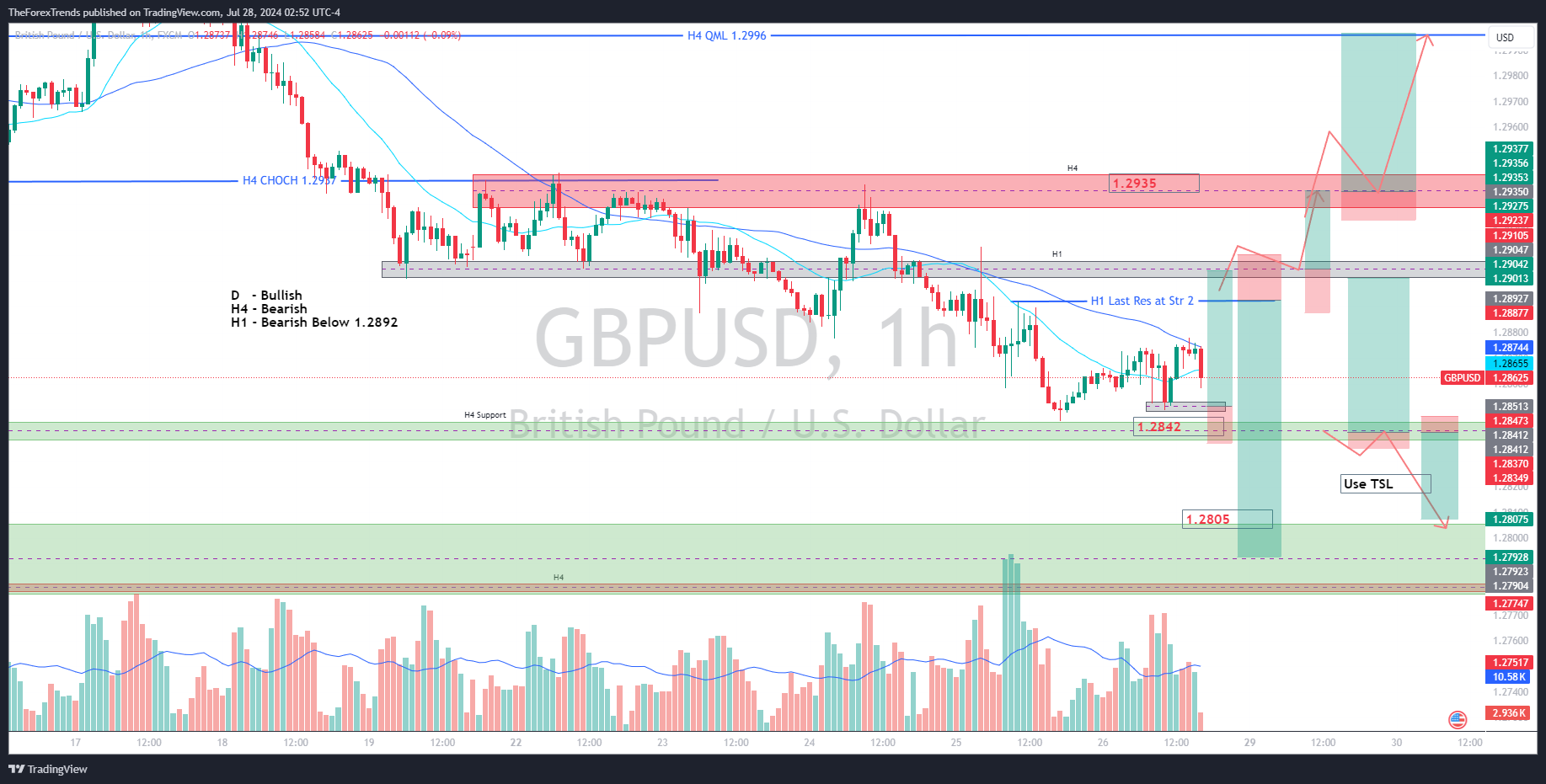

H4 Chart:

Based on my analysis of daily chart the technical outlook for GBP/USD suggests a potential fresh uptrend. Therefore, my bias is now bearish. Here are the key levels I'm watching:

Key Levels:

- QML (Quasimodo Level) - 1.2996:

- This level is likely to act as strong resistance. If the price approaches 1.2996, it could present a good opportunity for a short position, anticipating a rejection and a continuation of the bearish trend.

- Double Top - 1.3032 to 1.3045:

- The double top pattern in this range is another critical resistance zone. If the price revisits this area, it could be a high-probability selling opportunity, especially if there are signs of rejection.

Potential Strategy:

- Monitor Price Action:

- As the price approaches these key levels, we will watch for bearish reversal patterns such as bearish engulfing candles, pin bars, or other signs of rejection.

- Risk Management:

- we will set my stop-loss orders appropriately. For instance, stops could be placed above the double top level (1.3045) to manage risk effectively.

H1 Chart Analysis:

The H1 timeframe for GBP/USD is currently bearish as long as the H1 candle closes below 1.2892. Given the forthcoming economically crucial data for the UK and USD, we might see some consolidation before these data releases.

Strategy and Key Points:

- Bearish Bias Below 1.2892:

- As long as the price remains below 1.2892 on the H1 chart, our bias will stay bearish. This level acts as a crucial pivot point, and any H1 candle close above this could indicate a potential shift in short-term sentiment.

- Potential Consolidation:

- With important economic data on the horizon, it's likely that the market may enter a consolidation phase. This period can present various short-term trading opportunities.

- Scalping Opportunities:

- During this consolidation phase, we will look for scalping opportunities, keeping in mind the key levels shown on the chart.

- Key levels and price zones on the chart will guide entry and exit points for quick trades.

Summary:

In summary, the technical indicators and key levels based on the larger timeframe structure point to a cautiously optimistic outlook for GBP/USD, with the potential for a fresh uptrend if certain resistance levels are overcome, while maintaining key support levels to watch on the downside.

We will keep an eye on the economic calendar for significant news releases related to GBP and USD. Important events could cause volatility and impact the price action, potentially leading to breakouts or significant movements at key levels.

Stay updated with our latest analyses and insights into the Forex market. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments