THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

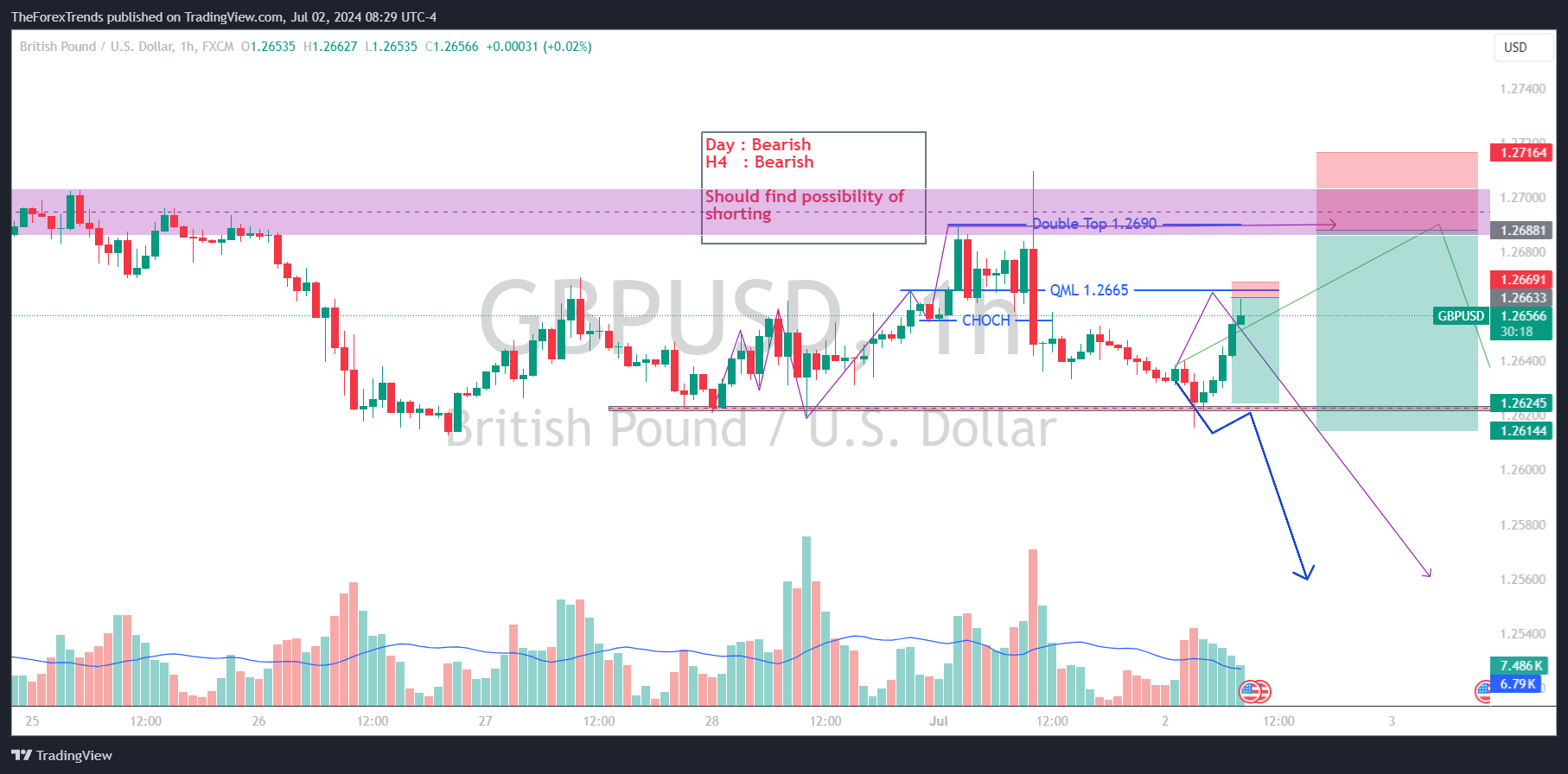

There is no significant fundamental news affecting the British pound (GBP) as of July 2, 2024. This allows technical analysis to play a more prominent role in guiding trading decisions for the GBP/USD pair.

Given the prevailing bearish trends on both the daily and H4 timeframes, traders should focus on looking for short positions at these identified levels.

With no major fundamental news influencing the GBP, the technical bearish outlook is reinforced. Therefore, seeking short positions at 1.2665 and 1.2705 could provide favorable trading opportunities.

This analysis provides a comprehensive outlook on GBP/USD. It's essential to perform your own analysis and practice on a demo account before engaging in live trading. The market can be unpredictable, and proper preparation is crucial for success.

Stay updated with our latest analyses and insights into the Forex market. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments