THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

The Japanese Yen (JPY) is influenced by various fundamental factors, including Japan's economic data, monetary policy by the Bank of Japan (BoJ), and geopolitical events. Recently, the BoJ has maintained its ultra-loose monetary policy, aiming to support economic growth and achieve its inflation target. This dovish stance has generally weakened the JPY against the USD. Additionally, global risk sentiment plays a significant role, with the JPY often acting as a safe-haven currency during periods of uncertainty. Any changes in these fundamental factors, including shifts in global trade dynamics or domestic economic indicators, could impact the JPY's value.

The Japanese Yen is also struggling due to overseas asset purchases by Japanese individuals through the newly revamped tax-free investment scheme. According to Nikkei Asia, the scale of these purchases is expected to exceed the country's trade deficit during the first half of this year.

The USD/JPY pair remains near 161.00 during the Asian session on Tuesday, July 9th. Market movements are influenced by Fed rate cut expectations. Traders are closely watching Fed Chair Powell's testimony for further insights.

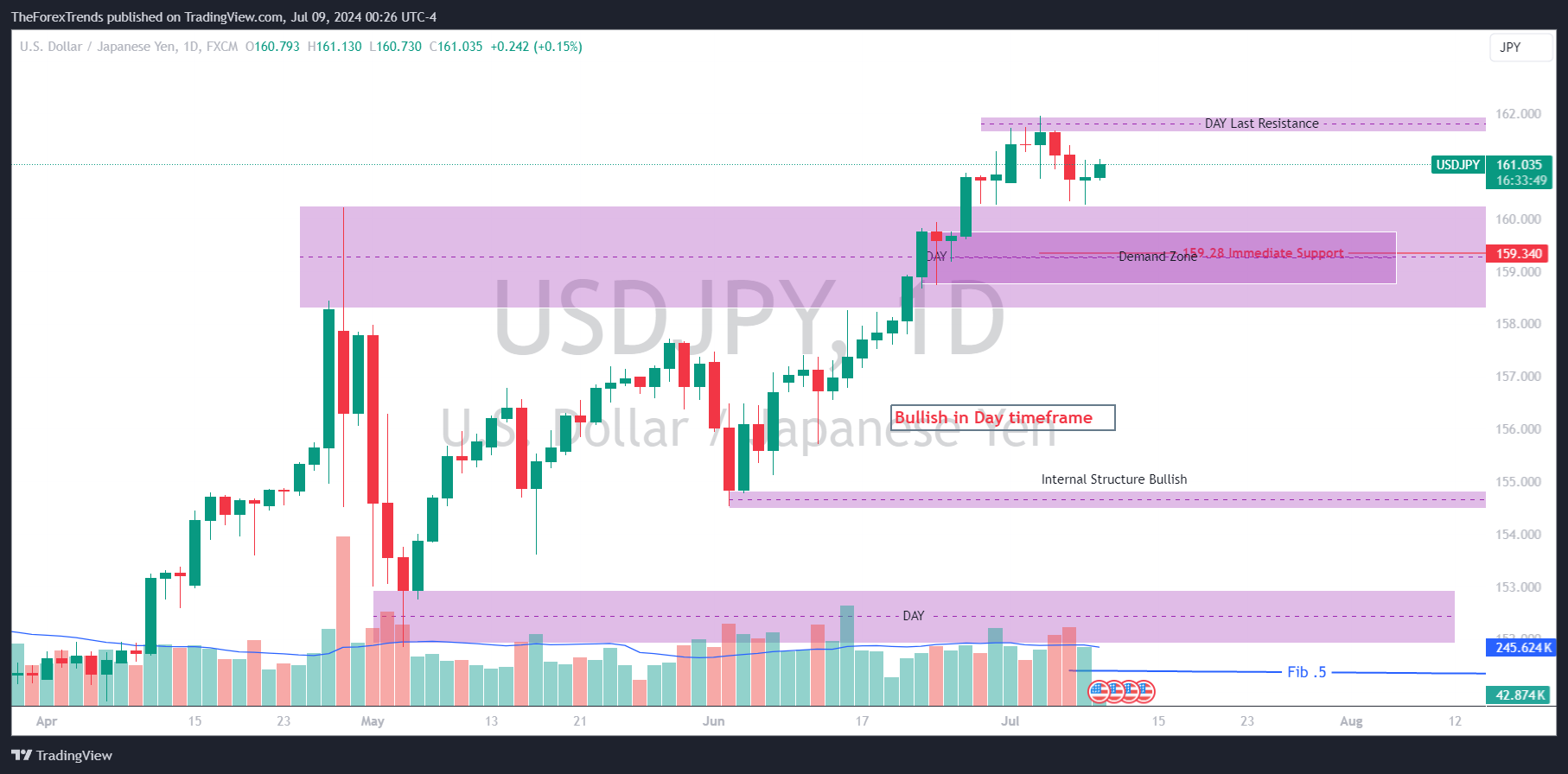

USD/JPY continues to follow an upward channel pattern, indicating a bullish trend based on daily chart analysis. Immediate support is at 159.28, with potential buying pressure at this level. The next support level on the daily chart is around 154.66.

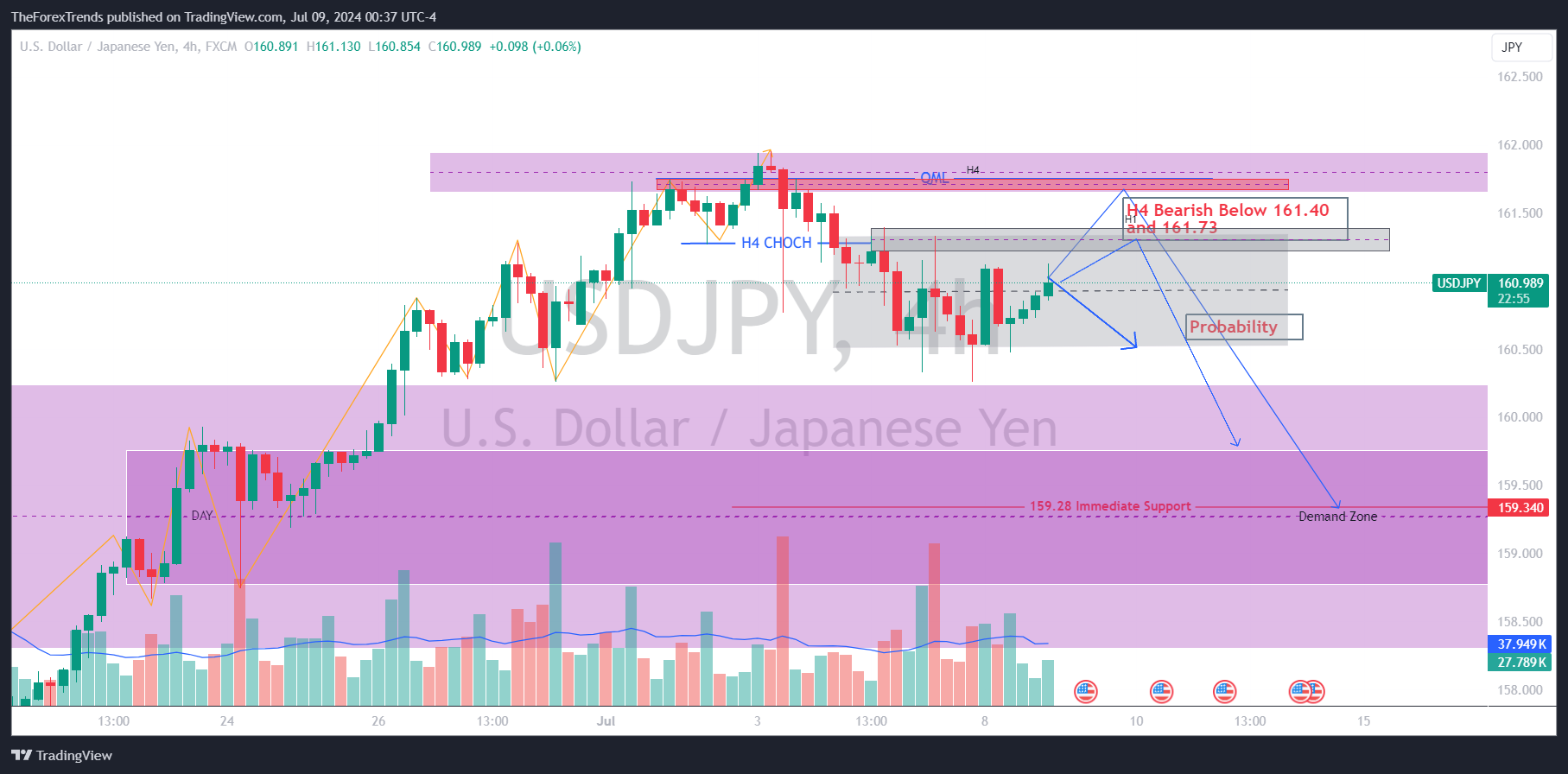

The H4 chart shows a bearish shift at 161.28, suggesting a short-term downtrend. A break below 160.29 could confirm further downside, targeting 158.80.

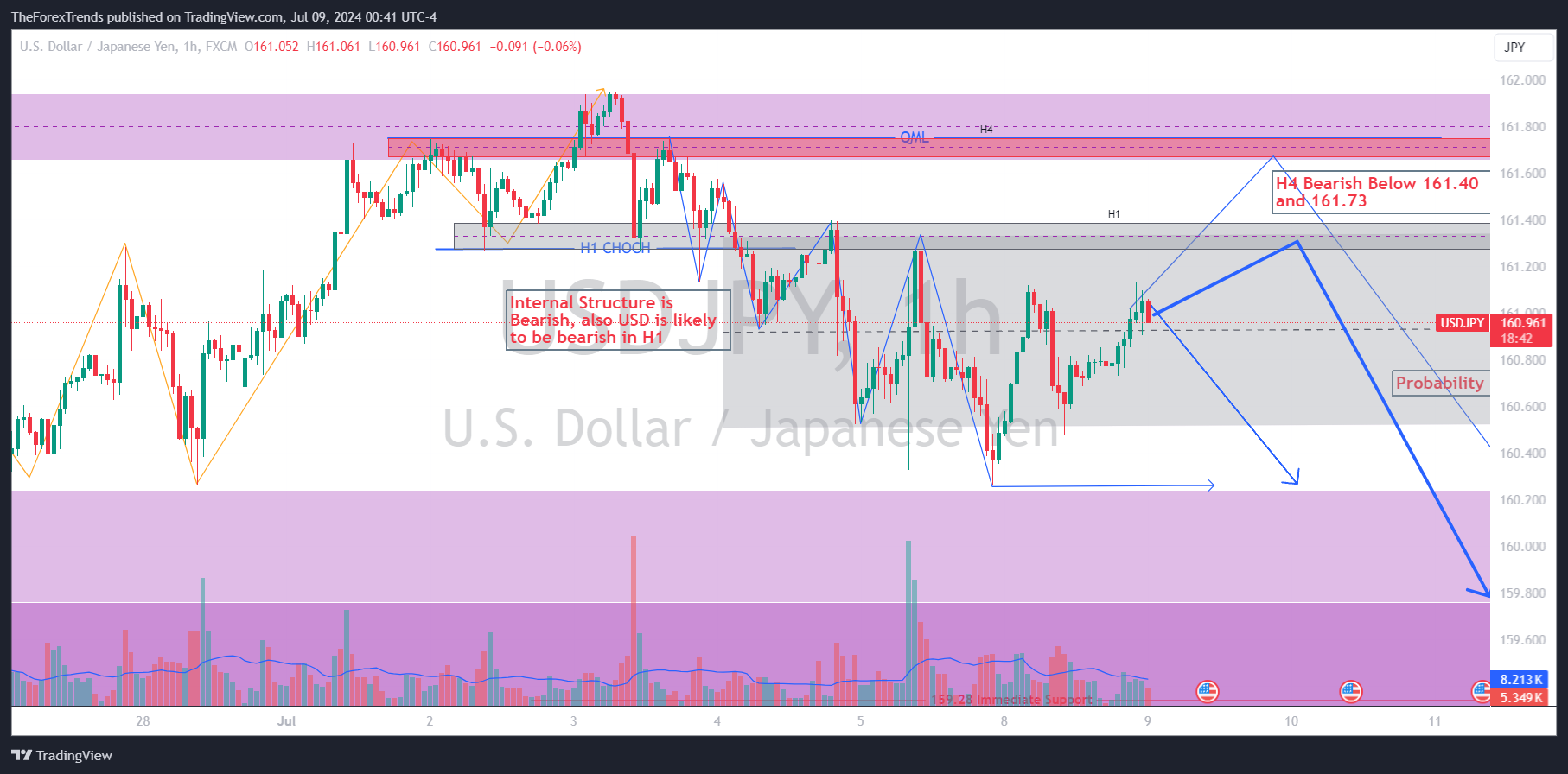

On the H1 chart, USD/JPY has completed five waves in a downtrend after the change of character (CHOCH) at 161.28, maintaining a short-term bearish trend. Key resistance levels are 161.30 and 161.74 (CHOCH level). Immediate support is at 159.28, with a break below this confirming further downside towards 158.80. Conversely, a break above 161.75 with strong momentum could signal a continuation of a larger frames bullish trend, with a higher high above 161.97 suggesting a resumption of the dominant uptrend, targeting 162.65 initially.

This analysis provides a comprehensive outlook on USDGPY, ahead of Fed Powell's testimony. It's essential to perform your own analysis and practice on a demo account before engaging in live trading. The market can be unpredictable, and proper preparation is crucial for success.

Stay updated with our latest analyses and insights into the Forex market. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments