THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

Last week, gold experienced profit-booking after rallying to all-time highs above $2,480. The yellow metal has been weighed down by a significant recovery in the US Dollar and bond yields.

Considering the upcoming US Presidential elections, there is increasing speculation that the Republican Party might win later this year. Exit polls and numerous media reports suggest that the chances of Donald Trump returning as US President have increased following an assassination attempt on him.

Another important factor to note is that gold has been in a bullish momentum for a couple of months due to growing expectations of a rate cut. This sentiment has already been priced into the gold market.

This week, several important news events are scheduled that will impact the US Dollar. Two key releases stand out:

Advanced GDP q/q for the USA: Scheduled for 12:30 PM GMT on July 25.

It's crucial to closely monitor both of these data releases for their potential impact on market sentiment.

The closing of this month's candle is crucial for us. As discussed in my previous analysis, the 2387.50 level is a key price because it represents last month's doji candle high. If this month's candle closes below this price, we could see a significant correction in gold. On the other hand, if the monthly candle closes above this key price, we could see a further bullish impulsive move above 2500.

Looking at the weekly chart, last week's candle is a no demand candle, indicating potential selling in the coming weeks. Additionally, last week's candle closed below the previous week's candle closing, suggesting selling opportunities from solid levels this week.

It's important to note that gold remains bullish when analyzing the daily frame market structure. It has formed a bullish break of structure (BOS) (refer below image). According to advanced market structure rules, when the market forms a BOS, we have two points of interest (POI) to join the current trend. Our first POI, which was in the 2430-2447 range, has been clearly broken. Now, the price may approach our second POI, which is around the 2300 level. Until the price breaks this level, we will remain bullish on gold.

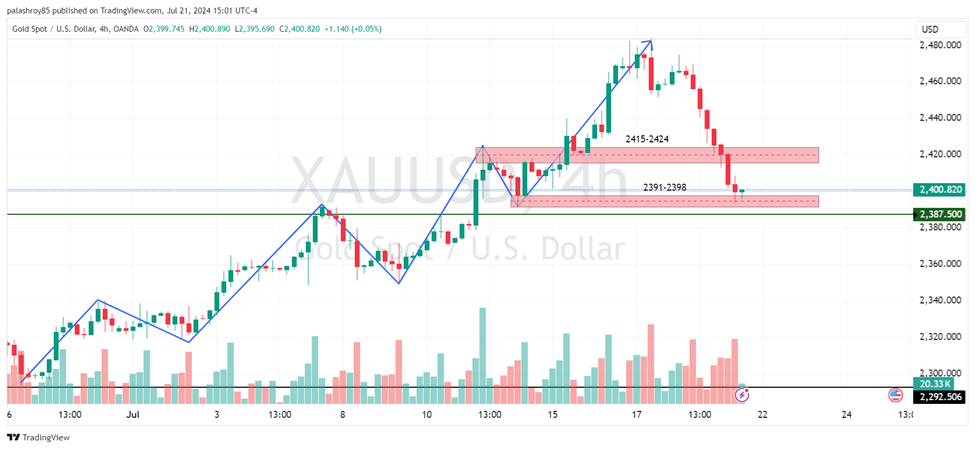

When analyzing the 4-hour frame for gold, it is evident that the market structure remains bullish. Despite significant selling observed last Friday, gold has yet to shift its structure.

According to advanced market structure principles on the 4-hour frame (as shown in the image below), we have two points of interest (POI) to join the current bullish trend. Our first POI, in the 2415-2424 range, has been broken by the price. Currently, the price is hovering around our second POI, which is in the 2391-2398 range.

The market opening on Monday will be very important for us. If the price breaks this last support as per the 4-hour structure right after the market opens, we will not look for buying opportunities in gold. However, if the price is unable to break this support right after the market opens, we may initiate a buy at around the 2400 level.

Typically, Mondays have lower market activity and volume, and there are no high-impact news releases scheduled. Therefore, we should aim to book our profits at a maximum of 100 pips.

Let's look at the 1-hour frame to identify intraday trading opportunities in the gold market for Monday. Firstly in 1 hour frame gold form change of character (ChoCh) that means it shift biasness from bullish to bearish as per the rule of advance market structure. As we know, gold is currently standing at a crucial support level on the 4-hour frame. If we get evidence after the market opens, we can initiate a buy from this level.

On the other hand, if the price breaks this strong support right after the market opens, we may look for selling opportunities after a retest of this zone.

Our first selling point is in the 2422-2424 range, which is a level where the 4-hour frame support becomes resistance and also aligns with the 38.2% Fibonacci retracement level. If the price reaches this level, we can look for a sell opportunity after getting confirmation.

Our second selling opportunity is in the 2430-2432 range, as this aligns with the 50% Fibonacci retracement level.

This analysis provides a comprehensive outlook on XAUUSD, combining technical insights with upcoming economic data. It's essential to perform your own analysis and practice on a demo account before engaging in live trading. The market can be unpredictable, and proper preparation is crucial for success.

Stay updated with our latest analyses and insights into the Forex market. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments