THE FOREX TRENDS

Revealing the World of Forex: Expert Analysis and Secrets of successful trading

Today at 6:00 PM IST, the Non-Farm Payroll (NFP) data for the USA will be released, with a forecast of 192k, which is less than the previous data. If we consider the recent macroeconomic data, it would be fair to say that the US economy is slowing down. Last week, Core PCE and Super Core PCE data surprised to the downside, and the soft ISM services report raises questions about whether the Fed can be more aggressive with their rate cuts.

However, traders should remember that the headline NFP figure tends to outperform the consensus about two times out of three. As we approach the NFP report with expectations for it to soften, an upside surprise could provide an opportunity for bears to fade into the US dollar rally in anticipation of lower prices in the coming weeks.

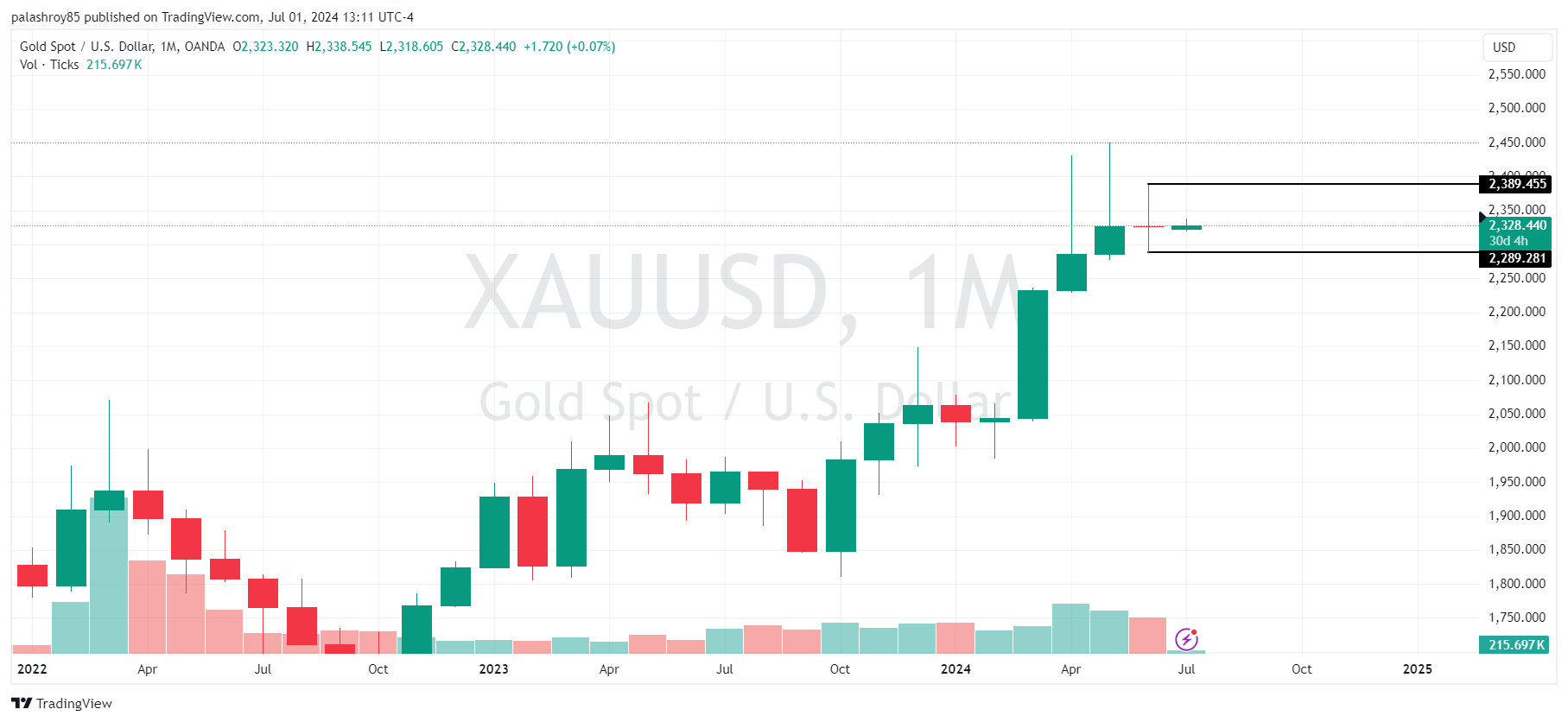

It is necessary to analyzing gold on a monthly timeframe today as it is a big day, the previous month's candle is an indecision or Doji candle. According to my strategy, I mark the high and low of the Doji candle. After a breakout above the high or below the low, the market usually finds a clear direction. If the price closes above the previous month's Doji candle’s high i.e 2387.5, we can expect a bullish trend.

Conversely, if the price closes below the Doji candle's low i.e 2287.82, a bearish trend is likely. This strategy is effective for swing trading or positional trading purposes as it is monthly time frame.

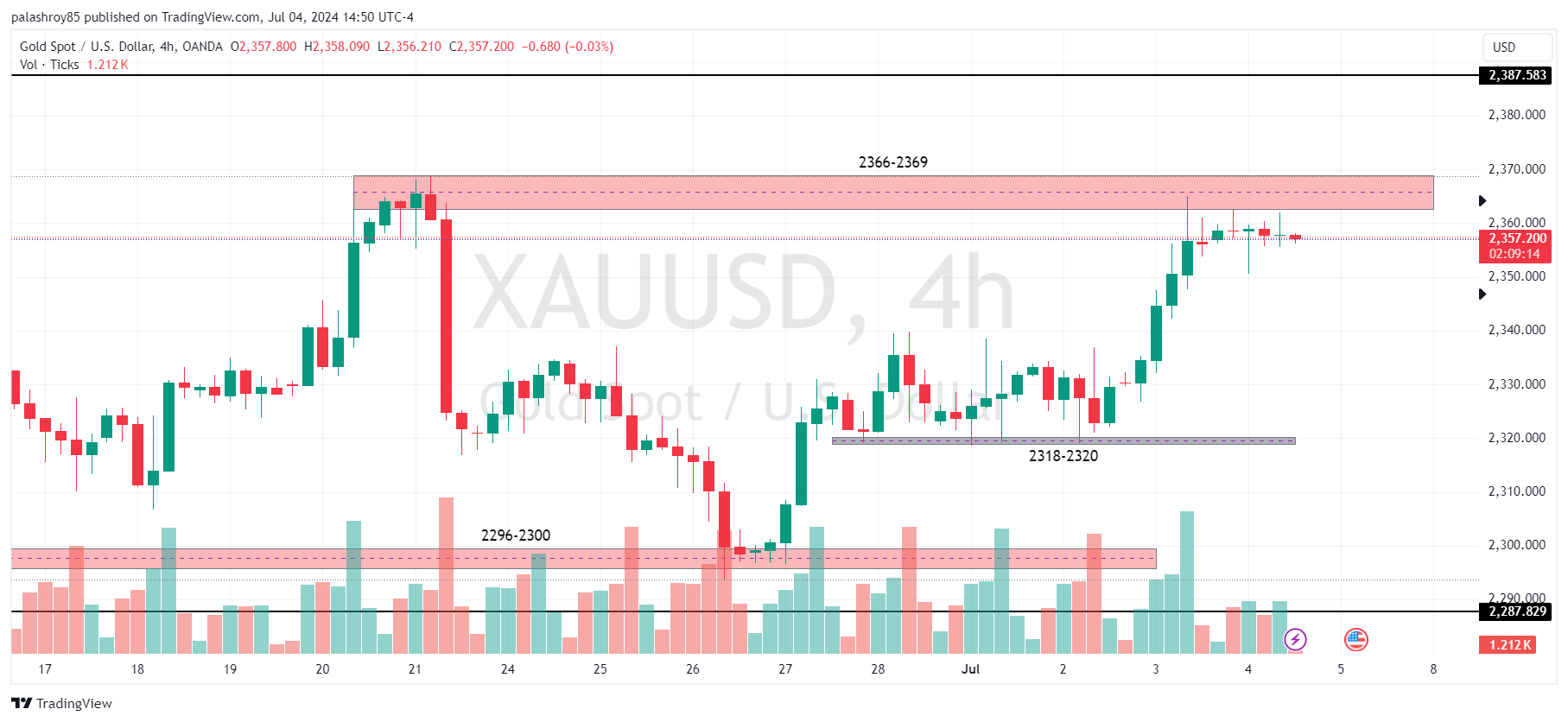

For intraday trading, we start by analyzing XAUUSD on the 4-hour timeframe. The market structure is still bullish, with an upper resistance at 2366-2369. If the price can break this level, it will create a bullish Break of Structure (BOS). Before the release of the NFP news today, we can initiate a sell from this zone for scalping purposes.

However, keep in mind that you should close all trades right before the news release due to high uncertainty. Let the market unfold after the news, and then we can take positions if the price reaches our analysis zones.

If, after the NFP data release, the price breaks the 2366-2369 zone with momentum candles, we can look for a buy opportunity after a retest in smaller time frames, such as the 5-minute or 1-minute frame, with proper risk management.

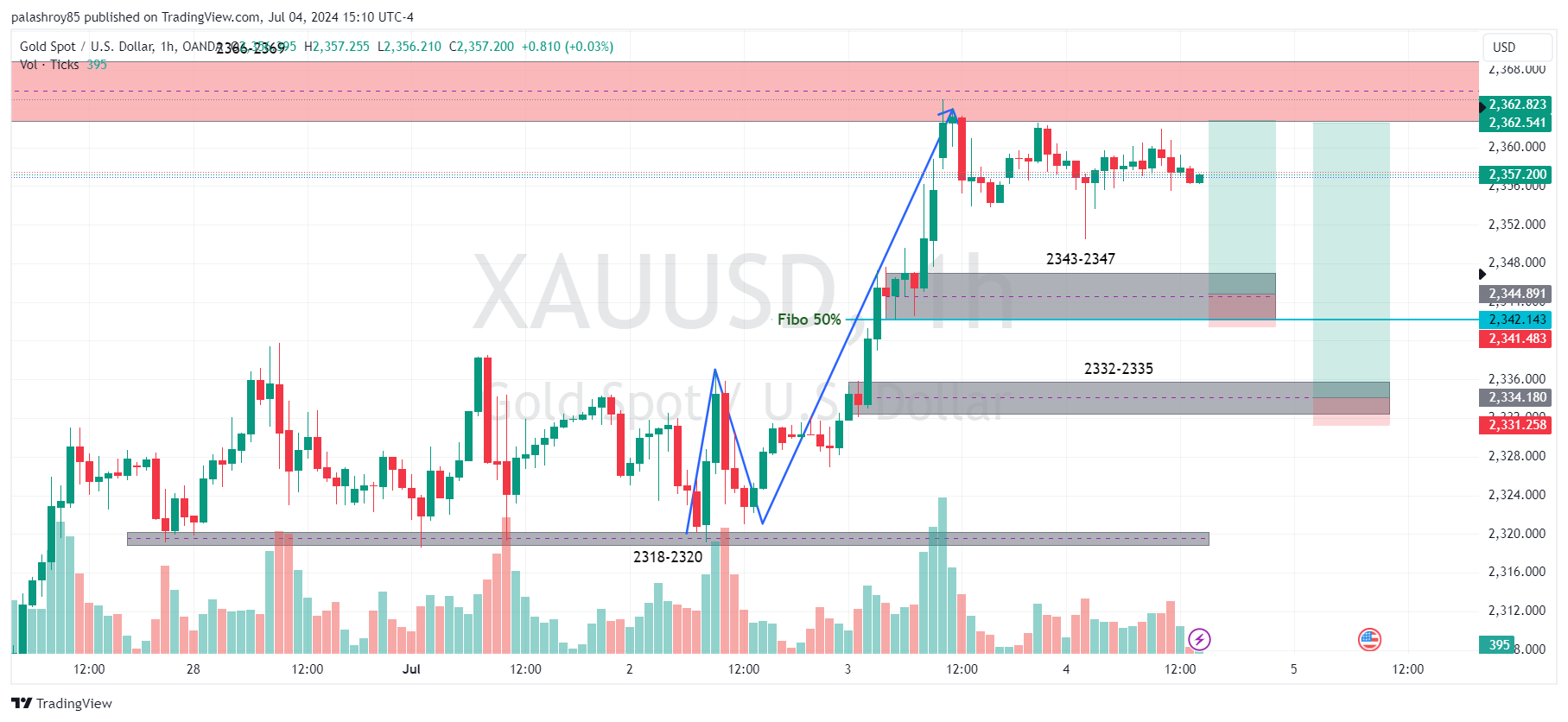

Now let's look at the trading possibilities for GOLD on the 1-hour timeframe for intraday/scalping purposes. If we draw the market structure on the 1-hour frame, you will see a bullish structure. As per the 1-hour frame structure, our first Point of Interest (POI) is 2332-2335 to join the existing bullish trend, and there is also demand available in this POI. If the price reaches this zone, we can look for a buy opportunity after getting some evidence.

On the other hand, if we plot the Fibonacci retracement on the last impulsive movement, we get the 50% Fibo retracement at 2342. In the same price range, there is also significant demand in the 2343-2347 zone. So if the price reaches this zone, especially during the London session before the news release, we may look for a buy opportunity after getting some evidence of volume or a smaller timeframe structural shift.

So, this is the gold analysis for today. Do not force your trades anywhere outside these zones. Wait patiently for the price to come to our levels. Respect your hard-earned money and follow proper risk management.

This analysis provides a comprehensive outlook on XAUUSD, combining technical insights with upcoming economic data. It's essential to perform your own analysis and practice on a demo account before engaging in live trading. The market can be unpredictable, and proper preparation is crucial for success.

Stay updated with our latest analyses and insights into the Forex market. If you have any questions or suggestions, feel free to contact us or leave a comment below.

Comments